Compare The Best Merchant Services

Opinions expressed here are the author’s alone, not those of any bank, and have not been reviewed, approved, or otherwise endorsed by any of these entities.

Want to jump straight to the answer? The best merchant service provider for most people is Stax or Helcim.

Merchant service providers give businesses the ability to process credit card payments.

Whether you’re a startup that’s accepting credit cards for the first time, or an established business looking for a better merchant service, this guide will steer you in the right direction.

The Top 10 Best Merchant Services

- Stax – Best for transparent, predictable pricing

- Payment Depot – Best for high-volume processing

- Helcim – Best merchant services for small businesses

- Square – Best for flat-rate payment processing

- Chase Payment SolutionsSM – Best for all-in-one direct processing

- PaymentCloud – Best for high-risk merchants

- Flagship Merchant Services – Best for exceptional support

- Fiserv – Best merchant services for retailers

- Dharma Merchant Services – Best B2B merchant services

- Stripe – Best for online credit card processing

After researching dozens of merchant services on the market, I’ve narrowed the list down to the top ten options for various use cases.

The reviews below contain the features, benefits, pricing, and potential drawbacks of each provider on our list. Following that is a brief guide discussing how you can use similar criteria to pick a merchant service that best fits your needs.

Stax — Best for Transparent, Predictable Pricing

- Transparent flat-fee pricing

- 0% markup on Interchange

- No contract

- 24/7 customer support

Stax has been in service since 2014 and has an ingenious subscription-based pricing structure that can potentially save high-volume businesses a lot in transaction costs. On top of that, Stax sets itself apart with a 0% markup on Interchange fees.

Due to its starting price of $99 per month, low-volume or new businesses won’t be best suited for Stax’s pricing model. However, for mid-size and growing businesses, professional services, membership businesses, and ecommerce shops, Stax is an excellent choice.

Stax prides itself on transparency in pricing. You can see this in the 0% markup on Interchange fees, month-to-month billing with no contracts, flat-fee pricing, and no early termination fees. And a 95% customer satisfaction score is nothing to sneeze at! Stax claims its customers save an average of 40% on transaction processing costs.

The subscription pricing starts at $99 per month, including a free terminal or mobile reader, ACH processing, analytics, and more. And the Interchange markup is 0% so it is only what is issued by the bank, there is no additional fee from Stax.

Transaction fees are 0.00% + $0.08 on swiped/chip transactions and 0.00% + $0.18 on online transactions. It’s important to note that this program is exclusively for companies based in the US.

If your business does over $500,000 per year, you’ll need to reach out to Stax to discuss custom pricing.

Stax also provides a robust knowledge base and 24/7 customer support. Learn more about Stax.

Payment Depot — Best For High-Volume Processing

- Transparent pricing

- No contracts

- No cancellation fees

- Lots of integrations

Payment Depot is one of the most reputable and reliable merchant service providers on the market today. They’ve been called the “Costco of credit card processing.”

By paying a monthly membership, Payment Depot offers low processing rates. This is especially true for high-volume merchants.

Merchants switching to Payment Depot typically save up to 40% on credit card processing.

Payment Depot offers transparent pricing with no hidden fees. You’ll benefit from no contracts and no cancellation fees.

Here’s a quick overview of Payment Depot’s plans and prices:

- Starter — $59 per month: Process up to $125,000 per year

- Starter Plus — $79 per month: Process up to $250,000 per year

- Growth — $99 per month: Process up to $500,000 per year

Transaction fees are 0.00% + $0.08 on swiped/chip transactions and 0.00% + $0.18 on online transactions. Please note that this program is for US-based companies only.

Payment Depot offers the ability to process more than $500,000 annually, but you will need to request a custom quote from the company.

Once you reach $25,000 in processing amounts per year, Payment Depot begins to offer significant savings over traditional credit card processing companies. Get started now with Payment Depot.

Helcim — Best Merchant Services For Small Businesses

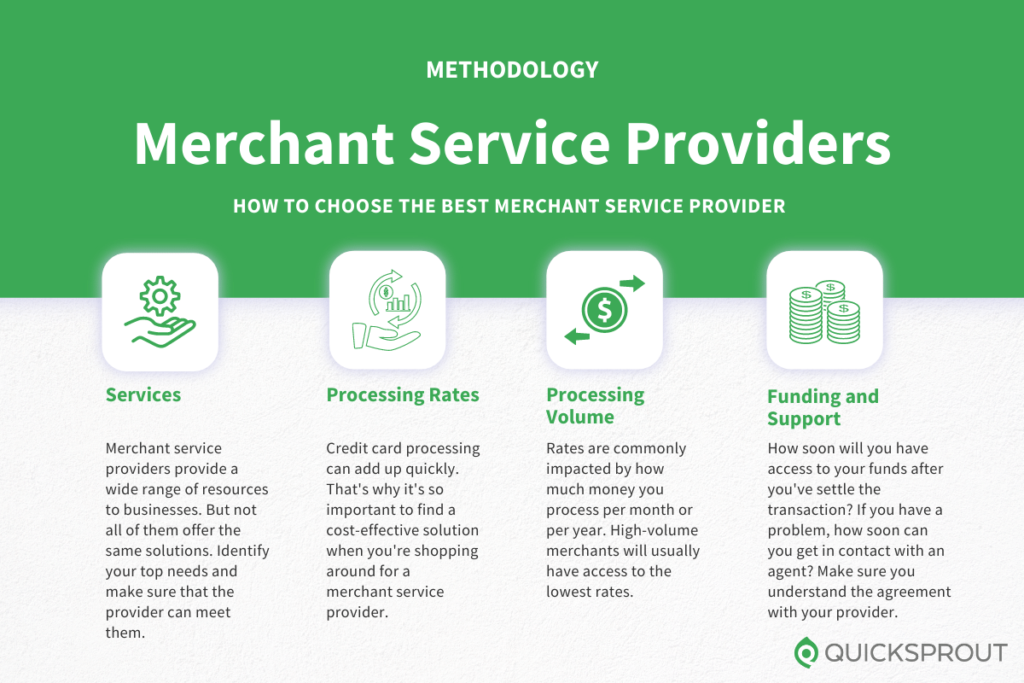

Helcim’s merchant services are designed for small businesses. They make it easy for you to accept credit and debit cards in person, online, and more.

Use Helcim’s services to set up recurring payments, send invoices, or collect payments over the phone with a Helcim virtual terminal.

Helcim’s card readers accommodate swipe, dip, tap, and chip payments. Accept Visa, Mastercard, Discover, Amex, Google Pay, Apple Pay, JCB, and more.

Other benefits of Helcim include deposits within two business days and the ability to securely store credit card information. You can use Helcim’s services for payment processing on your computer, smartphone, or tablet.

Sync Helcim directly with QuickBooks online to simplify your accounting.

Helcim’s price structure is simple and straightforward. Sign up to access low interchange-plus pricing based on industry, pay method, and monthly volume. Helcim offers volume discounts, no PCI fees, and no long-term contracts. Learn more and sign up at Helcim.

Square — Best For Flat-Rate Payment Processing

- Free magstripe card reader

- No setup fees

- No long-term contracts

- No chargeback fees

Square is one of the most popular merchant service providers on the market today. Millions of businesses trust Square for credit card processing and POS solutions.

In addition to point-of-sale, Square has services for online sales, delivery services, contactless payments, remote payments, and even marketing campaigns. Use Square’s platform to facilitate curbside pickup, digital invoices, appointments, and customer loyalty programs.

With Square for payment processing, getting started is easy. You’ll benefit from features like:

- No long-term contracts

- No early termination fees

- PCI compliance

- No setup fees

- No chargeback fees

- Real-time analytics

- Free card reader for magstripe cards

- Free dispute management

- Fraud prevention tools

As a flat-rate processor, you won’t pay any additional fees to accept American Express. All of your transactions will be processed at the same rate. The only factor impacting the cost is how the card is accepted (in-person vs. card not present).

In-person sales cost 2.6% + $0.10 per transaction. Ecommerce transactions and Square invoice sales cost 2.9% + $0.30 per transaction. Virtual terminal transactions, card-on-file transactions, and other card-not-present orders cost 3.5% + $0.15 per transaction.

While Square is a great option for those of you who want a flat-rate processor, these rates likely won’t be the cheapest solution for your business.

Chase Payment SolutionsSM – Best for all-in-one direct processing

- Direct processor

- Works for any industry

- Transparent pricing

- Multiple integrations

Chase Payment SolutionsSM is a subsidiary of another well-known name in financial services, JPMorgan Chase. Formerly known as Chase Paymentech and Chase Merchant Services, they have provided payment processing services since 1985 and process over $1 trillion annually.

But the most significant benefit to businesses looking for merchant services is that Chase Payment SolutionsSM is a direct processor–meaning they are both the payment processor and acquiring bank. With no middleman, your processing is more secure and takes less time than standalone services. Plus you get same-day deposits at no additional cost.

Chase provides integrated payment systems for businesses in almost every industry, including retailers, healthcare, and restaurants. And all Chase Payment SolutionsSM customers have access to support 24/7 year-round.

You can accept credit cards anytime, anywhere, including in-person, online, and even over the phone. For in-person transactions, Chase has various payment terminals, contactless mobile readers, QuickAccept, and a mobile app. For ecommerce stores, Chase integrates seamlessly with BigCommerce, Shopify, Spreedly, Volusion, and WooCommerce, plus virtual terminals.

Chase keeps pricing transparent with no monthly fees:

- Tap, dip and swipe transaction fees: 2.6% + $0.10

- Keyed transaction fees: 3.5% + $0.10 per keyed transaction

- Ecommerce transaction fees: 2.9% + $0.25

- Chase typically does not charge early termination fees

For an all-in-one service with a very recognizable name and secure transactions, Chase Payment SolutionsSM is a top choice for over four million businesses. Get started today by talking to a Chase representative.

PaymentCloud — Best For High-Risk Merchants

- No application fees

- No setup fees

- Ecommerce integrations

- Hardware options

Some businesses struggle to find a merchant service provider due to their industry. Certain payment processors and merchant services won’t consider merchants that fall into high-risk categories.

If your application has been denied by other merchant service providers, PaymentCloud will be a top option for you to consider. Whether you process payments online, in person, or on the go, PaymentCloud has solutions to accommodate your needs.

PaymentCloud seamlessly integrates Shopify, Magento, BigCommerce, 3DCart, PrestaShop, OpenCart, Volusion, WooCommerce, and more. There are no application fees and no setup fees.

Some examples of high-risk industries that work with PaymentCloud include:

- Firearms

- Software

- Adult businesses

- Tobacco

- Electronic cigarettes and vaping

- Diet programs

- Bail bonds

- Debt consolidation

- SaaS

- Dating services

Just fill out a form online, choose your terminal or payment gateway, and get ready to start processing credit cards.

It’s worth noting that PaymentCloud does work with all businesses—including ones that do not fall into a high-risk category. But with that said, I’d really only consider them for high-risk credit card processing. Other businesses can get better rates elsewhere.

Flagship Merchant Services — Best for Exceptional Support

- Accept all major payment methods

- Free processing equipment

- Guarantee to beat other rates

- Merchant cash advances

Flagship Merchant Services has been supporting businesses with payment processing solutions since 2001.

Trusted by more than 25,000+ merchants, this payment processor stands out from the crowd for its amazing support. If you have any questions or need some help before, during, or after the setup process, Flagship Merchant Services will always have your back.

You’ll even get a free POS system or EMV terminal when you open a merchant account with Flagship.

Other noteworthy highlights of using Flagship for payment processing include:

- Same-day funding

- Ability to accept all major credit cards and debit cards

- Ability to accept Apple Pay, Google Pay, and Samsung Pay

- Mobile payment solutions

- In-store payment solutions

- Online payment solutions

- MOTO (mail and telephone order) payment solutions

Whether you’re a retailer, restaurant owner, or running an ecommerce site, Flagship Merchant Services is an excellent option to consider.

They promise to offer the best rates on processing compared to any other provider on the market. If they fail to deliver on that promise, you’ll receive a $200 American Express gift card.

Beyond payment processing, you can use Flagship Merchant Services for cash advances, customer loyalty programs, gift cards, and business management tools.

Request a free quote to get started.

Fiserv— Best Merchant Services For Retailers

Fiserv provides financial services technology to financial institutions, corporations, consumers, and of course, merchants. Formally First Data, Fiserv is the world’s largest merchant acquirer.

The company has a wide range of services to accommodate both small businesses and large merchants with global operations.

Fiserv has solutions for retailers, service-related businesses, ecommerce websites, and food service businesses.

They have plenty of POS systems for retail merchants based on your unique needs. From full countertop stations to flexible card readers that work anywhere in the store, Fiserv has it all. You’ll have the ability to customize your POS system with customer rewards, gift cards, and insights.

To get started, connect with a Fiserv consultant to discuss your needs.

Dharma Merchant Services — Best B2B Merchant Services

- Level 2 & 3 processing

- High volume discounts

- Interchange plus pricing

- Next day funding

Dharma Merchant Services is one of the few providers on the market with solutions built specifically for B2B merchants.

With Dharma, your B2B can accept Level 2 and Level 3 card data from business credit cards. By processing these types of transactions, you’ll benefit from lower processing fees. Merchants that process more than $100,000 per month be eligible for even lower rates with Dharma’s high-volume discounts.

All Dharma merchant accounts include:

- Online reporting

- Next-day funding (for card-present transactions)

- Customer databases

- Credit card storage

- Mobile processing (Apple and Android)

- Virtual terminal

- Online payment links

Dharma Merchant Services uses interchange-plus pricing for credit card processing. There are no long-term contracts and no hidden fees, and you’ll receive excellent support from Dharma’s tech team.

Stripe — Best For Online Credit Card Processing

- Ecommerce payment processing

- Fraud prevention

- Virtual cards

- Developer-friendly API

For businesses selling exclusively online, Stripe will be the best merchant service provider to consider. The solution is made specifically for ecommerce websites and internet businesses.

It’s trusted by millions of organizations, from startups to Fortune 500s and everything in between.

Stripe has a fully integrated payments API to accommodate whatever products or services you’re selling online. It’s highly flexible for traditional B2C ecommerce, subscription businesses, and even ecommerce marketplaces.

In addition to payment processing, Stripe has merchant services for fraud prevention, invoicing, and issuing virtual cards. Stripe can help you obtain financing and manage your business spending as well.

Stripe’s API is developer-friendly and built to scale. Your payment infrastructure is virtually limitless with Stripe.

You will appreciate the streamlined process you find with Stripe, especially if you are selling to international customers. Stripe will automatically adjust its payment pages to adapt to the location of your customer, including using local languages and currencies.

Your customers can make use of a wide range of payment options. They will appreciate being able to select the payment method they prefer. Should the original payment request end up with a denial, Stripe delivers messages that encourage the customer to try again with another payment method, hopefully avoiding an abandoned shopping cart.

When you have a streamlined payment process on your ecommerce website, customers will be more likely to return for another shopping experience in the future.

It’s worth noting that this merchant service provider does offer terminals and solutions for in-person processing. But I’d only recommend that to merchants who are also selling online, with the online store as the primary focus of the business.

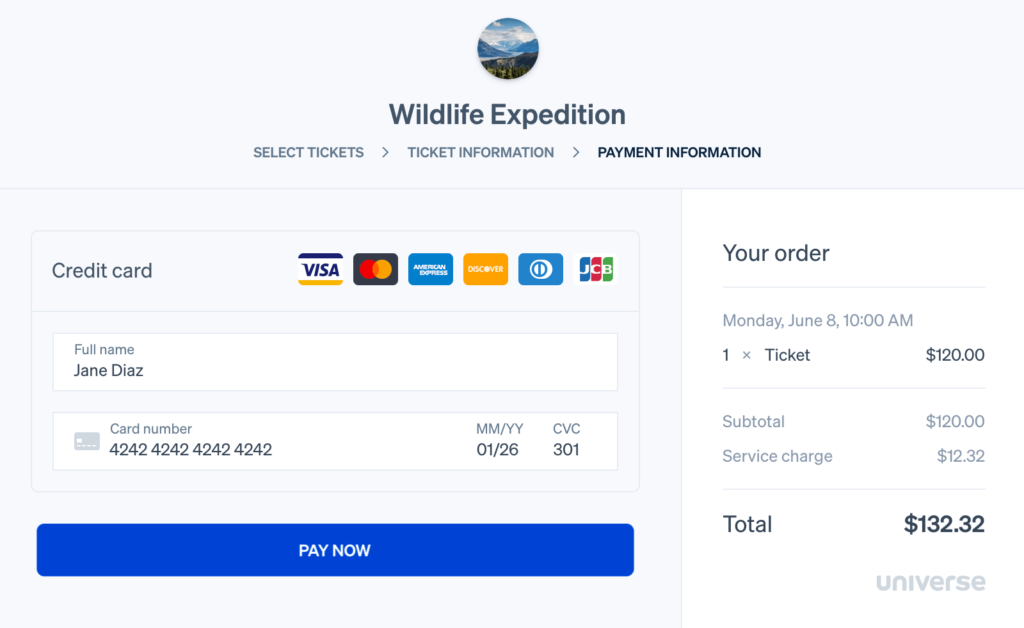

How to Find the Best Merchant Services For You

There are certain factors that must be taken into consideration as you’re evaluating prospective merchant services. The best merchant service provider for me might not be the best option for you.

This is the methodology that I used to pick the winners above. But overall, it depends on your specific needs.

Services Needed

Merchant service providers provide a wide range of resources to businesses. But not all of them offer the same solutions.

Every provider on our list offers credit card processing in one form or another. Other services to look for include POS solutions, hardware, virtual terminals, mobile payments, and ecommerce services. Some merchant services offer business financing, consulting, fraud prevention, customer loyalty solutions, gift cards, invoicing tools, chargeback management, and more.

Identify your top needs and make sure that the providers you’re evaluating can provide those services.

Processing Rates

Credit card processing can add up quickly. That’s why it’s so important to find a cost-effective solution when you’re shopping around for a merchant services provider.

Flat-rate processing is a viable option for smaller businesses that want a simple and straightforward solution. But generally speaking, interchange plus pricing will give you access to the lowest processing rates.

In some cases, you’ll have to pay a monthly membership fee to access the lowest rates.

If you have a B2B merchant category code (MCC), look for a provider that can accommodate Level 2 and Level 3 card data. This is another way to keep your rates low.

Processing Volume

Rates are commonly impacted by how much money you process per month or per year.

High-volume merchants will usually have access to the lowest rates. Depending on the merchant service provider, you might need to process anywhere from $500,000 per year to $150,000 per month to access those rock-bottom rates.

Funding and Support

How soon will you have access to your funds after you’ve settled the transactions? Look for merchant service providers that offer same-day or next-day funding.

You should also consider the level of support and service you’re getting. If you have a problem, how soon can you get in contact with an agent? How fast will your problem be resolved?

Make sure you understand the agreement with your merchant service provider. The best ones will offer free PCI compliance and won’t charge you for setups and cancellations.

Merchant Category Code (MCC)

Merchant category codes (MCCs) are used by payment brands, card issuers, and processors to classify the types of goods or services provided by a business.

Depending on your industry and business type, you might have an MCC that falls into a high-risk category—meaning your business is at a higher risk of chargebacks and credit card fraud.

Examples of high-risk categories include:

- Gambling

- Pharmaceuticals

- Telemarketing

- Tobacco and e-cigarettes

- CBD and marijuana

- Firearms and weapons

- Credit repair services

- Pawn shops

- Magazine subscriptions

The list goes on and on. If you fall into a high-risk category, not every merchant services provider will support your account. So you’ll need to find a provider that specializes in high-risk credit card processing.

Best Merchant Services: Your Top Questions Answered

The Top Merchant Services in Summary

Merchant services come in all different shapes and sizes. They can be independent service providers (ISOs), banks, or fully integrated systems for all of your hardware, software, and processing needs.

Stax, Helcim, Payment Depot, and Square are our top recommendations. But there are plenty of other great alternatives to consider, depending on your unique circumstances.