Compare The Best Online Payroll Services

Want to jump straight to the answer? The best online payroll service for most people is Gusto or Paycor.

A great payroll service makes it easy to process accurate payroll every cycle. You can rest easy knowing your tax obligations are calculated properly and filed with the appropriate parties, ensuring you avoid any penalties.

Switching to an online payroll service means you can automate your pay runs and stay compliant. This keeps your employees happy while simultaneously saving time and money.

The 6 Best Online Payroll Services

- Gusto — Best for dispersed workforces

- Paycor – Best for consolidating employee management

- Paychex — Best for experienced payroll teams

- OnPay — Best for simplifying all things payroll

- QuickBooks Payroll — Best for solopreneurs and small teams

- ADP — Best for never outgrowing your payroll provider

All six of our top picks will work for common payroll tasks like scheduling, new hire reporting, and security.

Where they differentiate themselves is how they perform in the key categories most users have said are critical. These include ease of administration, employee self-service, reporting, and tax management.

To find out how our recommendations work in the real world, we interviewed active users to understand how and why they chose the software they use. They walked us through the benefits and tradeoffs of using each payroll service, and shared insights you won’t find anywhere else.

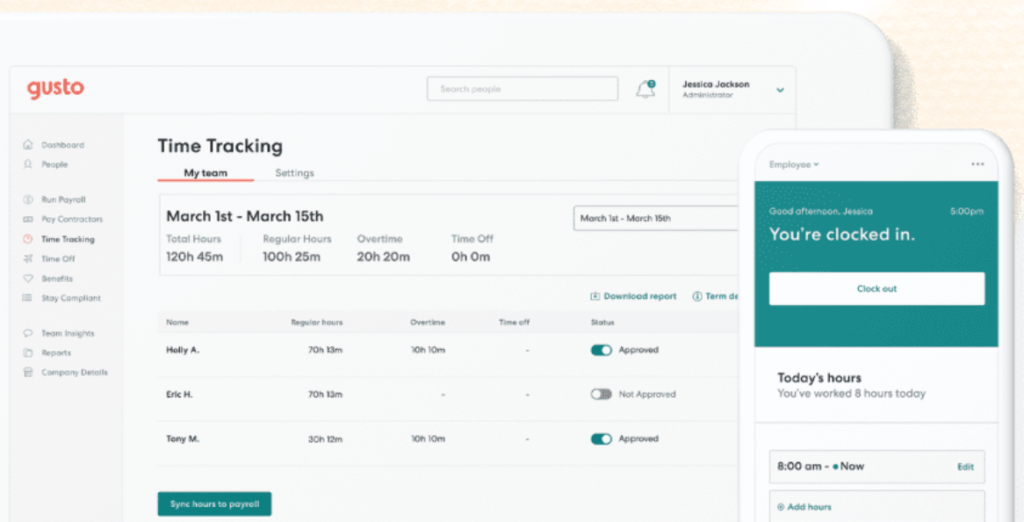

Gusto — Best for Dispersed Workforces

- Simple implementation

- Built-in time tracking

- Automated payroll cycles

- Local tax management

More than 200,000 businesses across the US rely on Gusto for payroll processing. This provider offers a comprehensive suite of features that makes it easy to onboard and manage your staff from anywhere.

Gusto simplifies payroll, benefits administration, and HR for dispersed workforces. Its friendly and engaging user-interface is loved by admins and employees alike.

Where Gusto Excels

Gusto is perfect for business owners who don’t have any prior experience running payroll on their own.

Whether you are administering payroll or setting up employee benefits, there’s tons of guidance along the way. You can easily handle your backend HR with Gusto—even as a complete beginner.

This combination of ease of use and robust functionality is why I included Gusto on my top five list and why it’s best for predominantly remote teams.

Here are the areas where Gusto really stands out:

- Easy for everyone to use: When you’re managing a remote workforce, onboarding new employees is a challenge. Gusto not only makes it easy for a new business to get up and running, but it is equally easy for new employees to get up to speed, too.

- Simple hiring and onboarding tools: If your business is growing, streamlining these processes is critical. Gusto lets you get new employees up and running in a completely hands-off way. This makes Gusto especially great for hiring remote employees.

- Built-in time management features: If your workforce needs to track its time, you can subscribe to a higher tier of Gusto service and have this feature included. This means you can skip the integration with a third-party tool. Contrast this with a similar service like OnPay, which only offers integrations and no native time tracking functionality of its own.

Users rave about Gusto’s clean and easy-to-navigate design. While the animated pigs and cartoon illustrations aren’t everyone’s cup of tea, they do resonate with Gusto fans. As one user we interviewed exclaimed, “Thank God we have Gusto. Look how easy this is. Yay!”

Onboarding new staff is also a breeze, with simple checklists, templates for essentials like offer letters, and the ability for digital signatures. Gusto makes it so easy for employers that in-person onboarding is quickly becoming a thing of the past, even for localized workforces.

Explaining how her company’s new employee onboarding process changed with Gusto, an HR manager for multiple $1 million companies said her team made an explainer video of how the employee’s new tablet works. Instead of a lengthy sit-down with a new hire going through the tablet’s functionality, her team simply shares that video via Gusto.

Likewise, new employees can onboard with ease, which is critical for remote workers. You can send an automated email series that walks the employee through all the tasks needed during the onboarding process. It lets employees work with manageable chunks of information, rather than experience data overload on their first day at work.

As she also found out, Gusto makes it understandable for even the least tech-savvy person on staff, saving her team time and energy addressing common user issues.

“The same group of people that are using Gusto are also using other platforms we use,” she said. “I hear all of this stuff around all of these other platforms, but I don’t around Gusto.”

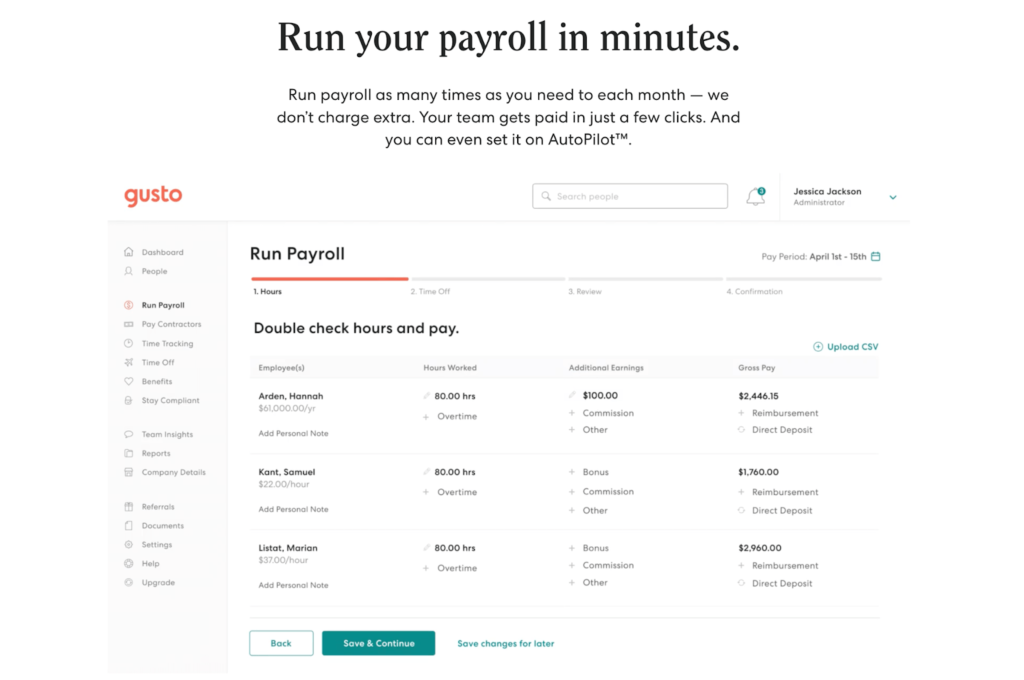

Gusto also gives you flexibility when it comes to paying staff each month, offering unlimited payroll runs. Just like OnPay, you’re not locked into predetermined payroll cycles nor charged extra if your payroll processing needs increase. With Gusto, you can adjust as your needs change or when you have to manage a one-off situation.

Unlike OnPay, Gusto gives you the convenience of automated payroll. This is an especially great feature for businesses with static payrolls, like an all-salaried team.

Once you set up the initial payroll information, you can set it to run automatically every pay cycle. Need to change something? A simple toggle switch lets you turn this feature on and off as needed.

Finally, if your business is subject to local taxes, Gusto makes it easy to manage and submit these withholdings. This is another area where Gusto pulls ahead of OnPay, which doesn’t offer this feature.

Combined, all of Gusto’s pros make it an ideal tool for growing businesses with dispersed workforces.

Where Gusto Could Improve

Of course, despite all the ways Gusto wins over users, it does have some shortcomings that bear calling out.

- Customer support: When it comes to keeping customers satisfied, Gusto stumbles. While they might answer your initial call quickly, users consistently said it takes multiple calls over days and weeks to actually resolve the issue.

- Integrations: Although Gusto says it “plays nice with your favorite software” and lists more than 100 third-party tools, user experience tells a different story. In particular, users had trouble trying to integrate Gusto with popular accounting packages like Xero, FreshBooks, and Sage.

- No PTO requests or approved-PTO syncing: To get the same PTO functionality of OnPay, Gusto users will need to subscribe to a higher-tier, more expensive plan.

Users we interviewed were united in their criticism of Gusto customer service. Although customer service representatives are available Monday through Friday with extended business hours, the reps seem ill-equipped to handle user questions.

Likewise, many users complained of long wait times and making multiple calls over many days and weeks to ultimately resolve questions.

“They ran me around in circles actually,” noted one former Gusto user. “I think it’s because they didn’t know…didn’t understand their own services.” This user eventually left Gusto because he wanted a more cut-and-dried approach to payroll management.

When you are a new startup without a dedicated HR department and want more hand-holding, this might be an issue. It’s also one area where OnPay and some of the other top five trump Gusto.

Limited benefits are another area where Gusto is a little weak. While they have built a robust, one-stop-shop for payroll and HR services, that comes at a cost. According to some users we interviewed, Gusto wants you to forego your existing service providers in favor of Gusto or one of its preferred brokers.

This was “not at all what I wanted,” said one former Gusto user. “I wanted them to do the payroll aspect. Not be a group manager for my healthcare.”

Likewise, Gusto’s HSA and FSA benefits are not yet available nationwide. While payroll and 401(k) are available everywhere in the United States, HSAs and FSAs are only available in 38 states plus DC. If your business or employees happen to be in one of the 12 states not yet covered, this will present a challenge—at least if you want Gusto’s services in this regard.

Similar to OnPay, Gusto relies on an optimized website instead of a dedicated app for mobile use. It isn’t a deal-breaker, but I am curious why a product with such a focus on the user experience skimped on this feature.

Gusto does offer a limited employee-facing app called Gusto Wallet. This lets employees see pay information and tax documents, but that’s about it. Everything else must be done in the web version of Gusto.

Most surprising on this list is Gusto’s difficulty integrating with common third-party tools, in particular accounting software. One of our interviewees struggled to connect Gusto with Xero, eventually giving up and leaving Gusto for another service. “They said it would sync, but they did not play at all nice together,” he noted.

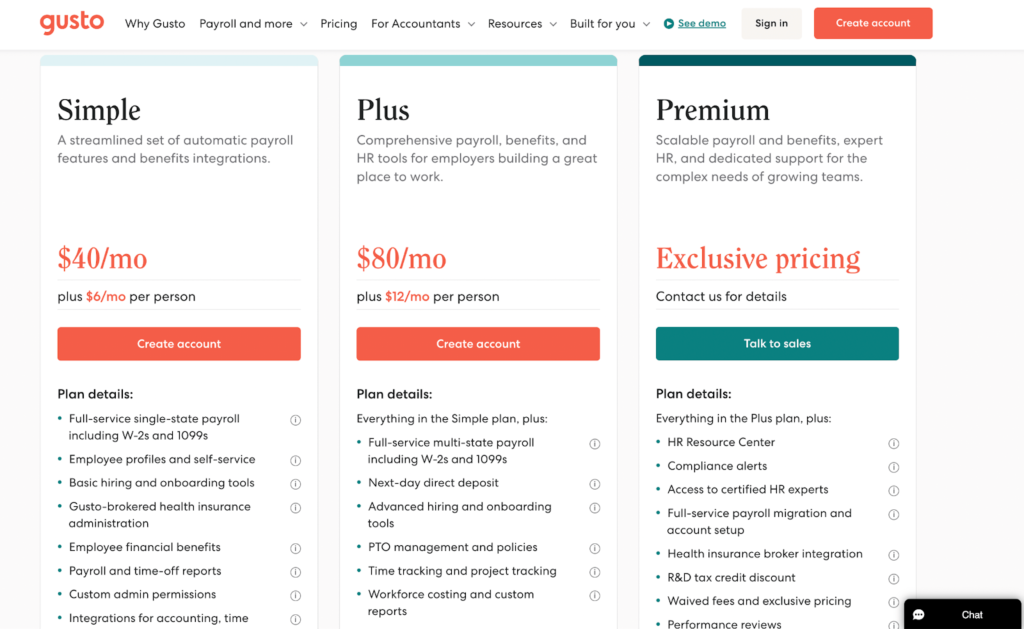

Gusto Pricing

Gusto recently revamped its pricing tiers and prices, offering three pricing tiers of Simple, Plus, and Premium.

- Simple – $40 per month plus $6 per month per user. You receive basic hiring and onboarding tools, full payroll support for one state, employee self-service options, time-off reports, and basic technical support.

- Plus – $80 per month plus $12 per month per user. You receive everything in the Simple tier, as well as full payroll support for multiple states, next-day direct deposit, PTO management, and full technical support.

- Premium – You must contact Gusto for pricing details in this tier. You receive everything in the Plus tier, as well as compliance alerts, health insurance broker integration, performance reviews, employee surveys, and dedicated technical support.

Whichever package you choose, Gusto also lets you add a la carte services for an additional fee:

- 401(k) plans

- 529 college savings plans

- HSAs & FSAs (not in all states)

- Worker’s compensation

Gusto also offers a contractor-only option for companies that don’t have any W-2 employees. It costs $6 per person with no monthly base price and includes limited services, including:

- Unlimited contractor payments in all 50 states

- 4-day direct deposit

- 1099-NECs

- New hire reporting, as required

Start your free 30-day trial, so you can see what it’s all about without any financial commitment.

Bottom line: Progressive business owners and HR professionals managing a workforce spread across diverse locations will love Gusto.

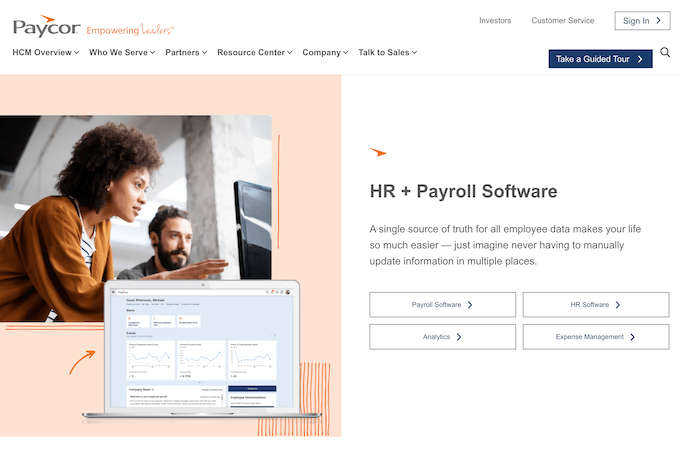

Paycor – Best for Consolidating Employee Management

- Full HCM Management

- OnDemand Pay feature

- Advanced paystub review

- Multi-language user interface

Paycor is one of the heavy hitters on our top six list. Its service offerings make it more akin to ADP than, say, Gusto or OnPay. For 30 years, Paycor has provided payroll software for companies of all sizes, but it has since expanded well beyond payroll processing functionality.

Paycor is a full-service human capital management (HCM) tool that bills itself as a partner that “empowers leaders to build winning teams.” It does so by offering a suite of services covering every angle of the employee experience, from recruiting and human resources to time and attendance, expenses, and payroll.

Its robustness makes Paycor a valuable solution for small- to medium-sized businesses. The company serves a broad swath of companies needing employee-management services, from less than 10 employees to those with more than 1,000.

Where Paycor Excels

Paycor is an established name in the payroll processing universe. It has more than 30,000 customers, most in the small- to medium-sized category.

Rather than focus on one offering, like payroll, the company positions itself as a partner to help grow managers into effective leaders by offering a variety of tools. Payroll is just one part of the bigger picture.

Customers appreciate how easy it is to process payroll and find the user interface attractive and straightforward. They also appreciate the HR Center of Excellence, an online repository of best practices, case studies, and informative articles.

- A simplified, single source of truth for employee data: Paycor’s HR and payroll software consolidates all employee information into a single location. This ensures that every person managing any facet of the employee experience has ready access to accurate and detailed data. It also eliminates the risk of incorrect data entry when information must be manually entered in multiple places.

- Flexible pay options: Paycor offers the usual direct deposit or auto-loaded paycards. But Paycor goes a step beyond with OnDemand Pay, a feature that lets employees access the money they’ve already earned before payday. Plus, the Paycor Wallet app gives employees a singular spot to access earned wages, request time off, see pay information, and access resources like budgeting tools, goal-based savings, and bill payments.

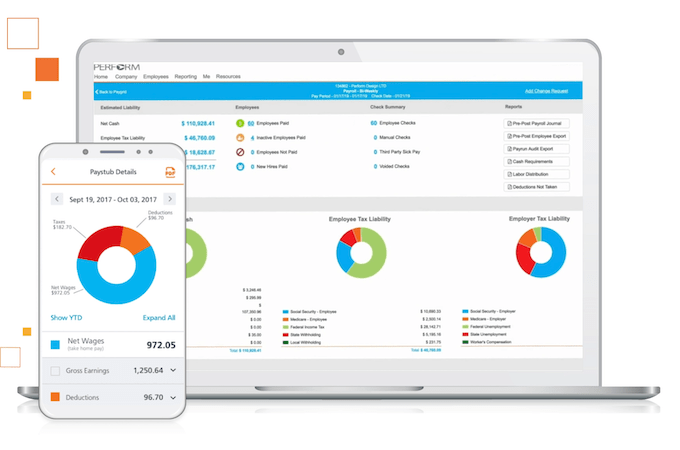

- Error-proof payroll: Employees can view their pay stubs three days before payday so that any mistakes can be addressed before payroll runs. When payroll updates need to be made, Paycor lets you do it in real-time, skipping the need to batch process. And time-consuming tasks like wage garnishments are deducted by Paycor, eliminating the administrative headaches for payroll administrators.

We are impressed by how many users raved about Paycor’s ability to simplify the administrative side of payroll and human resources.

One user called out the ease with which Paycor could be set up to quickly run payroll and how easy the interface is to navigate for basic payroll tasks. The user noted that it only takes five minutes to input employee hours into the portal and that taxes are all figured out automatically.

Customers also noted the helpfulness of having the interface available in multiple languages, including Spanish. This ensures that all employees can quickly and easily access the information they need, regardless of their language.

Another customer noted that Paycor stays current on emerging payroll management issues, like COVID leave. They also noted that having all employee information in one place greatly streamlines employee management and frees up administrative time.

Employees love the ability to quickly and easily access their information, especially from the mobile app. One employee likes that he can quickly see how much PTO he has available and then request time off from the same screen.

Another noted the importance of seeing his paystub days before the actual payday. He also appreciated the org chart, so he can quickly find others in the company when he needs to contact them.

Admins love the mobile app, too. They note fewer employee questions about things like W2s, paystubs, time off, and the like.

On the administrative side, customers appreciate the time savings that Paycor delivers. They are able use the time they used to spend managing onboarding and payroll on other, more revenue-generating tasks.

Where Paycor Could Improve

Of course, everything isn’t perfect with Paycor. There are some recurring complaints we heard from users, too.

- Customer service: It can’t be sugar-coated. Paycor struggles with delivering good customer service, particularly in the post-COVID era. While customers note that customer service was previously pretty good, it has fallen precipitously in the past 18 months.

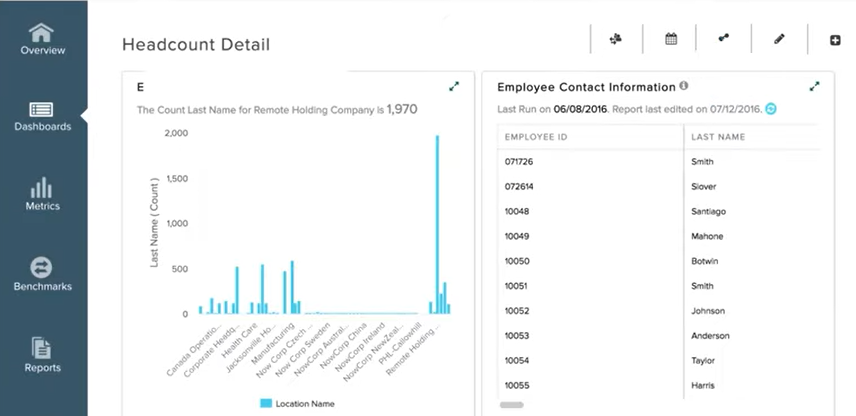

- Cumbersome reporting: While the user interface may be streamlined and intuitive, extracting data from the system in a usable format is often challenging.

- Unnecessarily complicated: Many users report that although the user interface is attractive and seemingly streamlined, it can be challenging to actually use.

Once upon a time, Paycor had great customer service. Or so the reviews say. That doesn’t appear to be the case anymore. Even a cursory glance at the most trusted review sites, including TrustPilot, G2, and Capterra, reveals a troubling decline in Paycor customer service.

Users note extended wait times and trouble getting through to a customer service representative. Once they do, their issues often go unresolved. Lack of knowledge and disinterest in resolving questions are two of the most often noted complaints. Help tickets languishing for months is another.

If you are the type of user who won’t rely on customer service after you go live with Paycor, this may not matter. But if you want the reassurance of having support in your corner outside of the knowledge base, this will likely make Paycor a source of frustration for you.

Reporting is another area of weakness. Users consistently note the difficulty in finding the reports they need. Once they do, they are locked into pre-built reports that don’t give them the information they actually want to see.

As one review we read noted, “if ad hoc reporting is important or crucial to you, this is not the product for you.”

The final area where Paycor can make some improvements is in the useability of the user interface. It gets good reviews for being visually appealing, but it sometimes suffers from making it overly complicated to execute simple tasks.

As one reviewer noted, “Sometimes I feel like there are 100 ways to do the one thing I want to do.” This sort of overkill doesn’t seem necessary. If it’s frustrating for users to move around the system, even the most attractive UI falls flat.

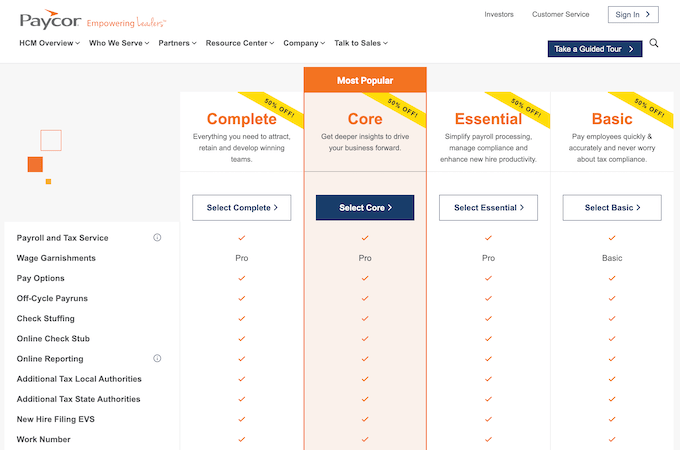

Paycor Pricing

Paycor breaks its pricing into two tiers—below and above 50 employees.

Below 50 Employees

When you have less than 50 employees, you can choose from four plans—Basic, Essential, Core, and Complete. You’ll be annoyed to learn that, unlike most other options on this list, Paycor hides all actual pricing.

You have to choose a plan, then submit your name and contact information to the site. Then, a sales rep will reach out to discuss your needs. Paycor does offer 50% off for one year, but you won’t know the actual value of that offer until you know the starting price.

Some internet sleuthing revealed that Paycor Basic costs $99 per month plus $5 per employee per month. Essential costs $149 per month plus $7 per employee per month, with a one-time setup fee of $59. Both the Core and Complete plans cost $199 each per month, plus $8 per employee per month for Core and $14 per employee per month for Complete. Both Core and Complete have setup fees of $99 and $199, respectively.

Above 50 Employees

There are no specific plans noted when you have more than 50 employees, so I can’t share any specifics with you.

You’ll have to submit your information, and you’ll get a note telling you a sales rep will contact you and that you’ll get three months of free payroll.

This puts Paycor in the unenviable position of being the least transparent payroll service provider on my list, despite being a great tool for HR management

Bottom Line: If you’re looking to simplify payroll and HR tasks, Paycor is a powerful and straightforward tool.

Paychex — Best for Experienced Payroll Teams

- Integrated time tracking

- Mobile app for admins

- Efficient customer service

- Deep tax & payroll knowledge

Paychex has over 50 years of experience providing a full suite of payroll, HR, time tracking, and benefits administration to businesses.

This exceptional service speaks to the market Paychex best serves—larger businesses. While they’ll gladly work with businesses with fewer than ten employees, Paychex’s sweet spot is larger organizations with lots of employees and a dedicated HR staff.

Unlike OnPay and Gusto, Paychex doesn’t focus on hand-holding for inexperienced users. Instead, their services are geared toward companies with complex payroll and HR demands.

Where Paychex Excels

Paychex has a very loyal customer base. Customers appreciate the strong customer service offerings, and they like being able to manage the service via a mobile app. Not only does the mobile app give employees the ability to self-manage their information, but admins use the app to manage the entire system.

Regardless of the way you want to pay employees, Paychex can accommodate your needs. The service supports paper checks for those who need them, but it also can handle a wide range of digital payment services to simplify and speed up the payment process.

- Advanced customer service: A company this size can offer 24/7 customer service, and Paychex delivers. At the higher subscription tiers, they also provide a dedicated payroll specialist for each customer. This specialist functions as the point of contact for all customer inquiries.

- Excellent payroll tax law knowledge: With the resources at Paychex’s disposal, you’d expect them to confidently manage tax laws at all levels, including local. And they do. The same can’t be said for Paychex’s heavyweight counterpart on this list, ADP.

- Integrated time tracking: Paychex focuses on making it easy to track employee time. The Time Clock feature works like a traditional punch-in/punch-out system. You can also use Paychex Flex Time, a dedicated solution for cloud-based time and attendance. Both of these time management options seamlessly transmit data to payroll and HR systems.

I was surprised at just how excited the users were when we spoke to them about Paychex’s customer service.

Most notably, they mentioned how quickly any issues get resolved. This extends to all levels of customer service—not just the dedicated payroll specialist. So even if you don’t choose a package that comes with an assigned specialist, you can still expect to receive excellent customer service.

As one Paychex user who manages a 35-person company noted, “Usually I will call if it’s like a payroll issue, and if my payroll specialist isn’t available, you go to anybody in the pool and 99%—I mean, probably even 100%—of the time, the person I speak to is extremely knowledgeable and will resolve it for me without having to go to my specific payroll specialist.”

When it comes to correctly processing taxes, Paychex also receives high marks. This isn’t surprising since Paychex has been at this for a very long time and has the resources to make sure nuanced tax changes are addressed, even down to the local level.

“Massachusetts recently installed a state-funded paid family and medical leave act,” the owner of a 100-person firm told us. “So that ended up being a new payroll tax and Paychex handled that without issue.”

If there’s ever a hiccup, users were quick to point out that Paychex owned the mistake and resolved it quickly on the customer’s behalf. One interviewee noted that Paychex also credited them several months’ worth of fees to make up for the inconvenience.

Paychex also puts focus on the mobile aspect of payroll in two ways. First, unlike OnPay or Gusto, Paychex does offer a mobile app for administrators. This allows admins to process payroll from anywhere at any time without having to use a web browser on their mobile devices.

Second, Paychex offers several time-tracking options that work for localized and mobile workforces.

“One of the big reasons for moving to Paychex was to take advantage of the online Time Clock,” said one Paychex user. “Having an automated system for checking in and checking out is super useful. This is a much more streamlined system. It definitely saves time.”

Reporting is a key component of any payroll service, and Paychex users had many good things to say about it. In particular, users loved the built-in Payroll Journal and Employee Earnings Report.

Users also noted that the drag-and-drop feature made it easy to pull customized information into reports. This is a standout among customized reporting across all products in my list.

Paychex definitely understands the sophisticated needs of its target audience and does a great job of satisfying them.

Where Paychex Could Improve

Although Paychex does a great job overall, there are still a few areas that could be improved to eliminate some recurring complaints.

- Complex user interface: While the design is far more bare-bones than OnPay or Gusto, Paychex makes it complicated with too many choices. This again speaks to their target audience not being the hand-holding type but instead seasoned HR teams. While an experienced HR professional probably won’t have trouble diving into Paychex, users with less experience often find it a challenge.

- Lots of integrations but difficult to integrate: With more than 100 available third-party integrations, Paychex seems to work with almost any other tool you might already use. However, many users note that actually getting the two to play nice together is harder than expected.

- Pricing is a huge secret: Paychex is very guarded when it comes to disclosing pricing. Unlike any of the other services on this list, Paychex makes you jump through a lot of hoops to find pricing or packages, if you ever do. Instead, they want you to sign up for a free consultation to get a custom quote.

When it comes to learning a new payroll software, there are two types of people—those who know a lot about the subject and want to dig in on their own, and those who are new to payroll and want more personalized attention.

Paychex is definitely a service for the former. One interviewee spoke about this when discussing how new employees were onboarded.

“My issue is just that I haven’t been handed anything that says ‘here’s how it should all work from beginning to end.’ I’m trying to figure that out all on my own,” she said. “It would be nice to have it all provided to me.”

While the admin user interface is pretty bare-bones, it still causes confusion for some. Experienced HR teams will no doubt jump in and enjoy the ride, but someone without much payroll or HR knowledge might feel intimidated and overwhelmed by the options. It is not impossible but will take a few payroll cycles to make it all feel natural.

One area that surprised me was user complaints about how difficult some integrations are, especially when it comes to time-tracking software. In some cases, the difficult integration results in additional work for a Paychex customer.

As one user illustrated, “Paychex has their own time-in reporting product. We don’t use that…because we already had one that was DCA approved because we’re a federal contractor. Paychex is probably DCA-approved, but why bother? Why recreate the wheel? So, we have a separate system and I have to put the PTO in manually to Paychex.”

It’s also worth noting that Paychex doesn’t share pricing information online, which means it can be hard to tell what Paychex is actually going to cost as you are shopping around.

“That’s probably one of my largest complaints working with Paychex,” one current Paychex user told us. “They do promote a low upfront cost because they factor in a number of discounts, but then those discounts over time just disappear.”

Likewise, the Paychex sales team didn’t escape scrutiny. Paychex salespeople are just plain pushy. Dozens of reviews ripped Paychex for their aggressive sales pursuits, including repeated emails, phone calls, and texts to existing customers. Their sales tactics, even for existing customers, leave something to be desired.

“The only issue I’ve had is their salespeople,” noted another Paychex user we interviewed. No other product on this list gets these kinds of complaints.

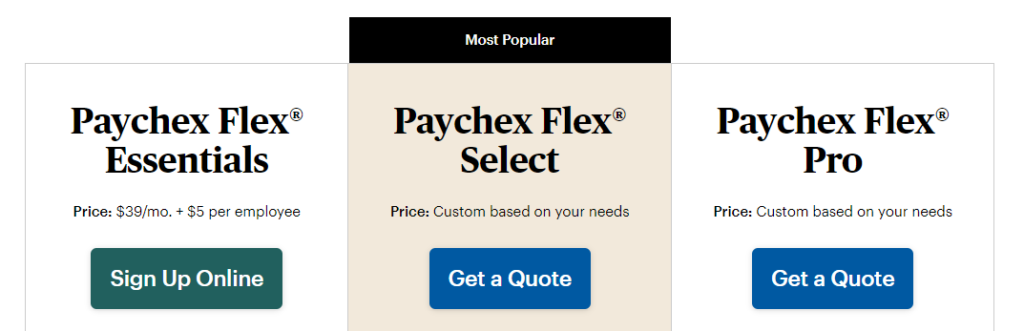

Paychex Pricing

Finding Paychex pricing information on their website is like searching for the holy grail. It might be out there somewhere, but it’s really hard to find. And when you eventually do find it, you feel like you accomplished something extraordinary.

This is a totally different approach than Gusto, OnPay, and QuickBooks, which all put pricing front and center.

- Flex Essentials – $39 per month + $5 per employee. Covers the basics. Offers fewer services for more cost than either Gusto or OnPay.

- Flex Select – custom quote only. All the services of Flex Essentials, plus a dedicated payroll specialist, mobile app for payroll administrators, access to e-learning services, and more employee pay options.

- Flex Pro – custom quote only. Everything from Essentials and Select, plus services typically only needed by larger businesses. Also, you have to jump to this tier to get basic services like accounting integrations and garnishments, services offered by others in the top five at lower price points.

- There’s no 30-day free trial, but Paychex does occasionally run specials that offer three months free. However, you’ll have to search to find those.

The danger with Paychex pricing, confirmed by numerous user reviews, is that costs can go up fast, especially as a la carte services are added. Some people leave the service over price increases.

Bottom line: For the experienced payroll team or HR professional, Paychex is an incredibly powerful tool.

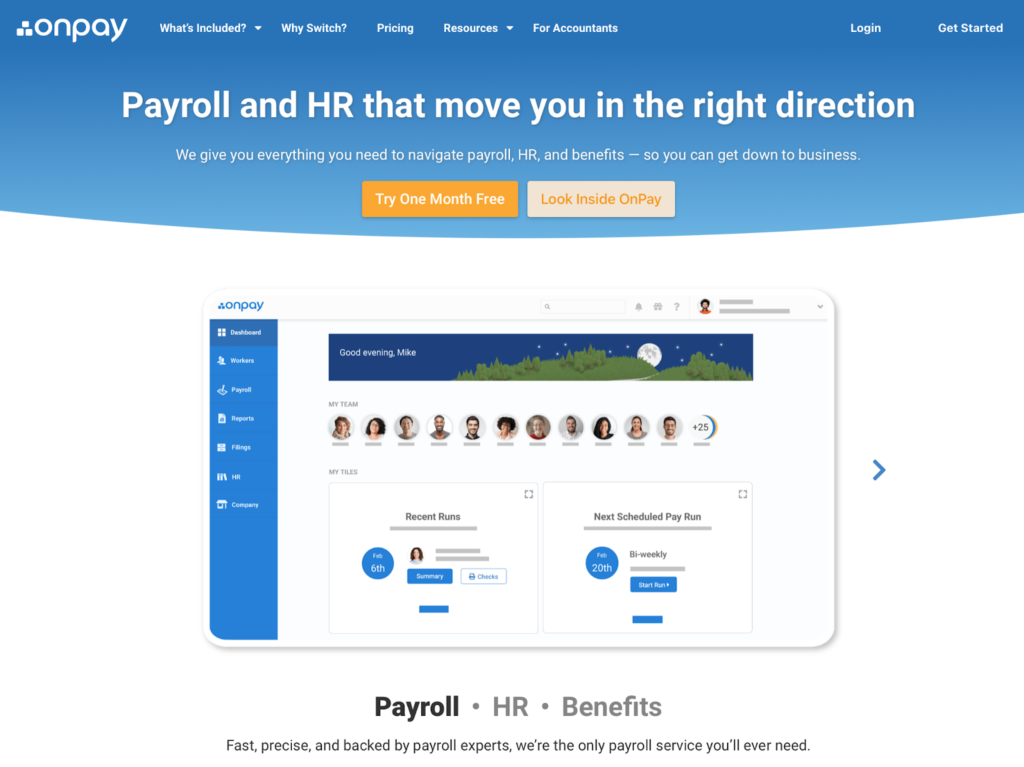

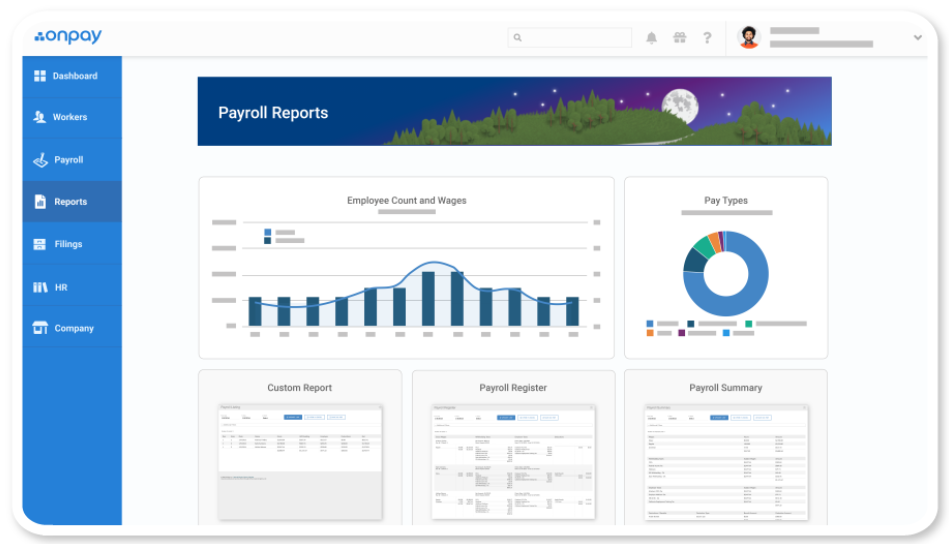

OnPay — Best for Simplifying All Things Payroll

- Easy to use

- Simple pricing

- Stellar customer support

- Streamlined integrations

OnPay began as an internal solution to help simplify one family’s payroll business. A decade later, OnPay is one of the most highly-regarded payroll services on the market.

Their focus on simplifying the complexities of payroll landed OnPay on my list.

No dedicated payroll or HR person at your company? No problem. OnPay successfully helps anyone master payroll management, regardless of experience level.

Where OnPay Excels

OnPay delivers in a host of key areas that make it ideal for inexperienced payroll users.

- Simplified payroll management: OnPay’s laser focus on making payroll as easy to understand as possible makes it a tool anyone can successfully use. You don’t have to be a seasoned HR professional to successfully run payroll each month.

- Easy employee onboarding and access: Most of the most common tasks like self-onboarding and reviewing payroll documents can be painlessly completed via OnPay’s website. This eases frustration for the employee and saves time for the employer.

- Stellar customer service: OnPay’s emphasis is on simplifying payroll for everyone, so it makes sense they put a strong focus on helping their customers. OnPay resolves issues quickly and effectively with no long hold times, unlike some of its competition on this list.

Users we spoke to, especially those with no formal payroll or HR experience, really liked how easy OnPay is to use.

“It’s easy for an individual who is not necessarily an accountant to operate this system,” noted one user, “like where you have a business owner who’s going to be doing this stuff.”

OnPay also receives high marks on the employee use side. Reviews we studied consistently noted how easy the platform is for employees to access and navigate. They can self-onboard, print out paystubs, and change tax forms on their own.

OnPay comes with the basic HR tools any small business needs, like automated onboarding workflows, customized PTO tracking, and new hire compliance reporting.

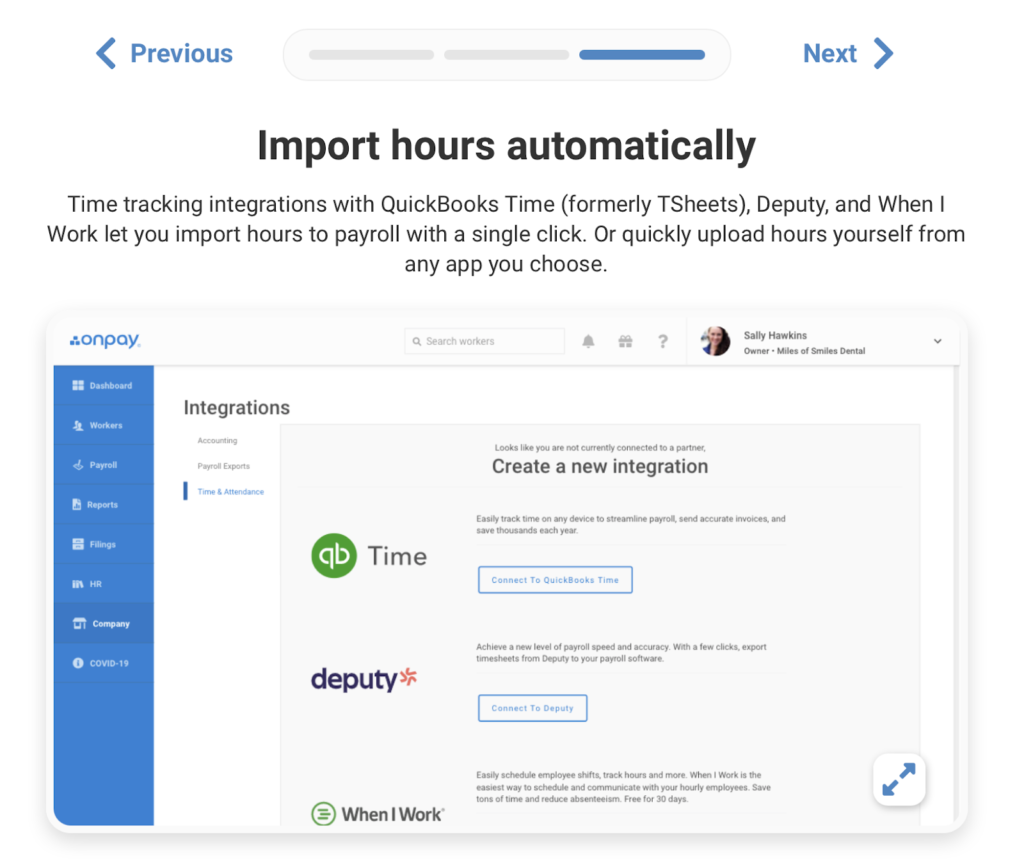

If you want or need more options, OnPay integrates smoothly with a select number of third-party apps for accounting, time management, 401(k), and compliance. It bears noting, though, that OnPay offers the fewest third-party integrations of any product on my list.

Still, if you’re using a tool in OnPay’s current integration repertoire, OnPay walks you through connecting the two with ease.

“We’ve chosen to integrate OnPay with a time management system called Deputy,” noted the business manager of a small health clinic. “It’s incredibly simple.”

When questions arise, OnPay ensures fast answers.

“I think the longest I ever had to wait on hold was 10 minutes and they are always very helpful and polite,” the owner of a busy veterinary practice told us. “Their response every single time has been ‘we’ll take care of this for you,’ and they always do.”

And if a payroll tax mistake happens, OnPay doesn’t let its users go it alone. Another user we interviewed noted, “If I get a message saying there’s a [tax] miscalculation, I go straight to OnPay and they’re like, no worries, we’ll explain what we did, why we did it, and you shouldn’t have to worry about it.”

Another area where OnPay shines is reporting functionality, especially its pre-built reports. The people we interviewed and the user reviews we read online raved about how easy OnPay reports are to find and use, especially the year-end reports.

And when customized reports are what a user needs, OnPay simplifies the process with its Report Designer feature. A simple drag-and-drop user interface lets you add or remove up to 50 data points, move columns, adjust date ranges, set up filters, and create custom views for individual users.

OnPay’s customization extends to payroll cycles, too. Unlike others on my list, OnPay lets you run unlimited payroll cycles every month at no additional cost.

For small businesses, this is an especially important feature, as one user pointed out who forgot to add a new employee before running payroll.

“I forgot to click a button,” she recalled. After running the direct deposit payroll and seeing that she missed the new employee, she was able to go back in, quickly cut a check by hand, and ensure the new employee got paid on time. OnPay “is a great tool for me, because sometimes I forget to click a button.”

All in all, OnPay delivers where it matters most by taking the guesswork out of payroll.

Where OnPay Can Improve

No online payroll service is perfect, and OnPay is no exception. The software’s focus on making payroll as easy as possible also creates some gaps in functionality. Whether these gaps are a big deal depends on your needs.

- No automatic payroll option: While OnPay lets you run unlimited payroll cycles each month, there is no set-it-and-forget-it feature. You have to manually approve payroll every time, even if the data doesn’t change from cycle to cycle. All other top five products can do this.

- Some functionality is difficult to master: Despite its focus on simplicity, many users report unnecessary complexity in certain areas, particularly onboarding their more complicated processes at startup and extracting specific information from the system.

- No mobile app: OnPay is browser-based with no mobile app for any device. Other tools have made a mobile app necessary in today’s tech-driven world.

- Integrations are limited: Although OnPay integrates smoothly with the third-party tools listed on its website, those options are limited. There were less than 20 third-party tools at last count. All the other products on this list offer a far more robust portfolio of integrations.

One notable deficiency is the inability of a payroll administrator to set up automatic payroll cycles. You have to go in and manually work through two screens and a confirmation page each time you run a payroll cycle with OnPay.

This probably isn’t a huge hurdle for a small company with only a few employees or a payroll that fluctuates. But for a company with a large workforce of salaried employees, this can quickly become an unnecessary burden. Other products on my list, like Gusto, Paychex, and ADP do offer this set-it-and-forget-it convenience.

While OnPay strives to be easy to use, there are some aspects where users struggle or face seemingly unnecessary annoyance.

One user we interviewed cited trying to find individual 401(k) information as an example. “I have to go into the 401(k) listing and then unclick everybody that I don’t want. I’d rather be able to just … click the person I want and run the report.”

Other OnPay users mentioned struggling with the onboarding process, at least for more complex situations. One person we interviewed noted that managing benefit accrual for different compensation schemes wasn’t easy to get set up.

Then there’s the lack of a mobile app for administrators or employees. OnPay claims its website allows users to run payroll from anywhere with “just one bar of reception.” But a well-designed app is simply more intuitive and easier to use. Both Paychex and ADP have robust mobile apps. Even Gusto offers a limited mobile app for basic employee self-service.

A somewhat more niche issue arises for businesses that operate in places with municipal taxes. OnPay can’t handle local taxes, so if your business is subject to these, you’ll want a payroll service that can manage them for you. All the other choices on my list offer this service.

Finally, OnPay drops the ball a bit with fewer than 20 third-party app integrations. It lags far behind its competition in this regard. This also leaves a pretty wide gap for new OnPay users who already use accounting, time management, and 401(k) tools that aren’t on the list.

OnPay Pricing

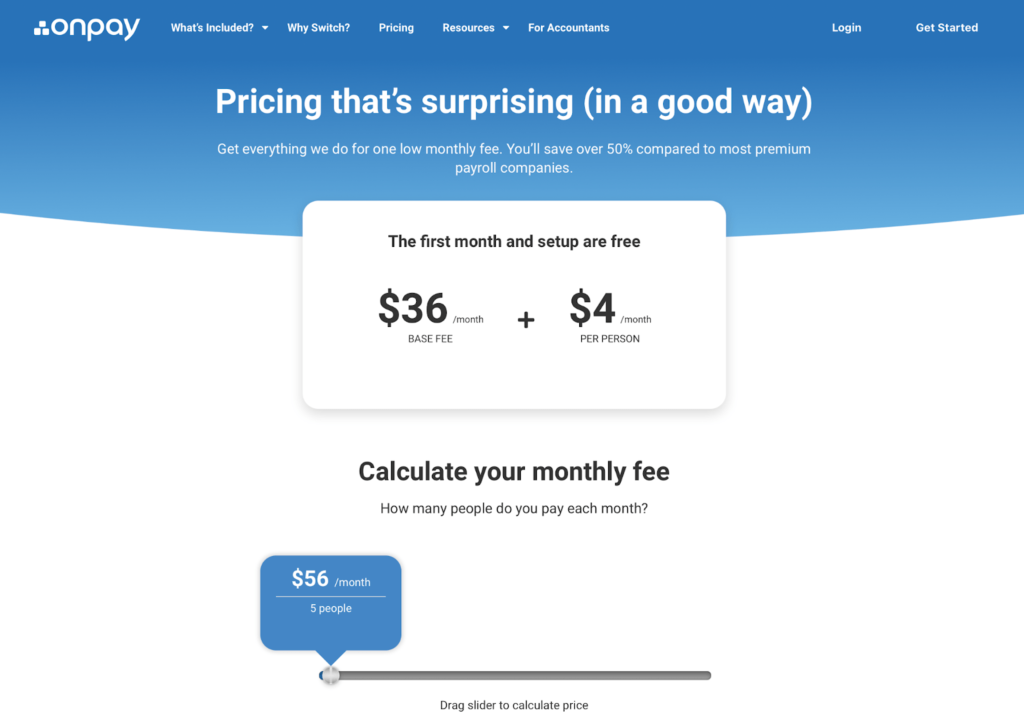

Forget complicated tiers and customized quotes; OnPay offers all its services for one transparent monthly fee, and it’s a fee that puts OnPay among the most affordable options on my list.

Their approach to pricing also garners rave reviews from actual users. “If you’re a small business like we are…it is an incredible value,” notes the business manager of the small health care clinic.

OnPay costs just $36 per month plus $4 per person per month. That’s it. No contracts. No mysterious fees. No uncertainty.

There’s even a simple calculator on their website that lets you see exactly how much you’ll pay.

Other key features of OnPay’s pricing:

- 30-day free trial

- Migration costs from your previous payroll provider are covered

- No contract, cancel anytime

Bottom line: Small business owners and managers without payroll expertise will love the simple interface, solid customer service, and budget-friendly pricing. Try OnPay now for 30 days to see if it is right for your business.

QuickBooks Payroll — Best for Solopreneurs and Small Teams

- Great, affordable pricing

- $25,000 tax penalty protection

- Mobile app for time tracking

- Streamlined payroll processing

The power of a brand can never be understated, and QuickBooks is an instantly recognizable name in accounting software.

The company has spent decades earning its reputation as being reliable and easy to use. This reputation extends to QuickBooks Payroll.

It’s a no-brainer to tell you that QuickBooks Payroll is perfect for anyone already using QuickBooks for their accounting. You can even integrate the two from within QuickBooks accounting software with just a click.

But QuickBooks Payroll is also perfect for any small business that wants a standalone, trimmed-down product for payroll management—something that’s easy to use and gets the job done without unnecessary bells and whistles.

QuickBooks delivers a compact package of payroll services at a reasonable price, best suited for individuals and small companies that prioritize cost over extra functionality that they don’t need.

Where QuickBooks Payroll Excels

QuickBooks Payroll offers a number of great features that are perfect for the solopreneur or business owner tasked with managing small teams.

- Very intuitive: QuickBooks Payroll nails it when it comes to making it easy for people with little to no payroll background to get people paid. Its new Payroll Tax Center dashboard makes the entire service easier to use.

- Tax penalty protection: Uniquely among products on my list, QuickBooks Payroll offers actual monetary protection (up to $25,000 per year) to cover tax penalties and interest. While you have to be on the highest tier of service for this coverage, this type of insurance can save a small business from financial ruin.

- Simplified time tracking: QuickBooks Time allows users to track time on the go via the website or a dedicated mobile app, then feed the data back into QuickBooks Payroll automatically.

The users we interviewed all used QuickBooks Payroll in conjunction with QuickBooks. They unanimously agreed that QuickBooks Payroll saved them significant time every month. It also trimmed down expenses.

One user noted that before turning to QuickBooks Payroll, they were spending at least an hour each month running payroll. Since converting, though, their processing time has been reduced to just minutes.

And, as another interviewee noted, “It’s saving me money from having to pay my accountant/bookkeeper.”

For users willing to pay a bit more each month, QuickBooks Payroll’s tax penalty protection can be a real lifesaver. When you are on the IRS’s radar, things can get sticky fast. Knowing your payroll software has your back can be worth the extra cost of the higher tier package.

The reviews we read and the users we talked to consistently heaped praise on the prebuilt reports, as well. While 20 ready-to-go reports may not seem like a lot, for users with simpler needs, it is a nice compromise between covering the basics and overwhelming a user with too many choices.

Time tracking is a huge win, too. The QuickBooks Time mobile app for Android and iOS lets you accurately track hours no matter where or when an employee is on the clock. There’s even geofencing technology baked into the app, something unique among our top five products.

Users also find QuickBooks Time easy to manage and quite versatile, with one user even adopting it as an internal way to manage billable hours for clients.

“We use QuickBooks Time in a way that wasn’t designed for, but…works for us,” noted one user we talked with. “We’re a marketing agency, so we have our different customers and…we track the time we’re spending on any given account and any given day. It’s for internal tracking, just so we’re not over-servicing or under-servicing a client.”

QuickBooks Time is available as an a la carte service at the lowest QuickBooks Payroll subscription tier and included at the higher tiers.

Where QuickBooks Payroll Could Improve

QuickBooks Payroll is great for many things, but not everything.

- Limited integrations: If you’re not using QuickBooks Online for accounting, the third-party tools you can integrate QuickBooks Payroll with are extremely limited. In fact, you can only integrate with other Intuit products.

- Customer service leaves much to be desired: Slow to respond, slow to follow up, and difficult to contact were just a few of the comments we read and heard about QuickBooks customer service.

- Few HR tools: QuickBooks Payroll lags here, especially when compared to what the other top five offer. For users who want both payroll and HR, this is an issue.

The biggest issue for QuickBooks Payroll is how limiting it is for anyone not already using, or willing to adopt, QuickBooks for accounting purposes. Without it, users can’t make use of the 650+ third-party integrations QuickBooks Payroll boasts about.

Users also cannot integrate QuickBooks Payroll with any other accounting software. That’s a huge limitation for anyone wanting to do more than the basics of payroll.

Also, of all the products on our top five list, QuickBooks Payroll really drops the ball with customer service. Dozens and dozens of reviews consistently mention bad customer service—in particular, long hold times.

“If you have a problem with QuickBooks and you try to call them, you’re going to be on the line forever trying to get help,” noted one person we interviewed.

Likewise, when unexpected problems arise users often have to turn to third-party resources for more information. One interviewee experienced this first-hand.

“The direct deposit payment was supposed to hit on the 30th, and nobody got it,” he noted. “I sent it and then found out through the [QuickBook] forums that it was a QuickBooks issue.”

Many users report significant issues with employees not getting paid or tax-related issues with the IRS. These complaints stretch back all the way to 2016. Combined with limited customer service, these unexpected hiccups can be very frustrating for an inexperienced payroll manager.

Limited HR tools are another sore spot. There’s no easy or fun onboarding experience like Gusto and OnPay offer. You also don’t get the higher-level employee benefits of ADP and Paychex.

You can only start capturing a small portion of these services with QuickBooks Payroll’s highest-tier plan, which is far more expensive than OnPay or Gusto.

Tax calculations are also a potentially problematic area for some businesses. QuickBooks Payroll requires manual entries for workers who perform services in multiple states.

The same holds true for employees that move often. QuickBooks Payroll will only track a maximum of two states. So if you have a multi-state workforce, you might find QuickBooks Payroll a bit limiting.

This is likely not an issue for most solopreneurs or very small companies. But it is an example of how QuickBooks Payroll is not ideal for larger companies with many employees.

QuickBooks Payroll Pricing

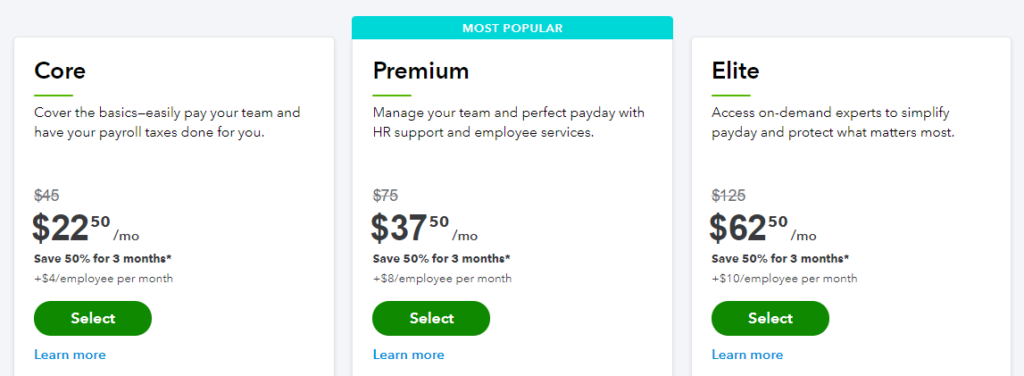

QuickBooks Payroll offers some of the least expensive pricing on our list, including 50% off for the first three months. Only OnPay costs less after the three-month discount is removed.

This affordability makes QuickBooks Payroll a solid choice for an individual or small business that really just wants to manage a small payroll and doesn’t want to pay for unnecessary extra features.

In line with targeting individuals and small businesses, QuickBooks Payroll offers crystal-clear pricing on its website. This makes it easy for anyone to understand options and start service with just a few clicks.

QuickBooks often runs promotions, so you may be able to get a lower price today. Regular pricing is as follows:

- Core – $45/mo plus $4/employee. This is the entry-level plan and offers auto payroll, 1099 e-file and pay, product support, and next-day direct deposit.

- Premium – $75/mo plus $8/employee. All Core offerings, plus same-day direct deposit, expert payroll review, mobile time tracking

- Elite – $125/mo plus $10/employee. All Core and Premium offerings, plus expert setup, mobile time tracking, 24/7 support, tax penalty protection, HR advisory services

QuickBooks Payroll also offers a la carte services, including:

- 401(k) plans

- Health benefits

- Time tracking app

- Worker’s compensation administration (higher tiers only)

- HR support center (higher tiers only)

QuickBooks Payroll offers a 30-day free trial, plus special introductory pricing of 50% off for the first three months.

Bottom line: If you’re a solopreneur or small business owner with less than 10 employees who just wants straightforward payroll services, check out QuickBooks Payroll.

ADP — Best for Never Outgrowing Your Payroll Provider

- Mobile apps for admins & employees

- Flexible payroll processing

- Comprehensive reporting

- Tons of integrations

ADP is the most dominant name in the payroll industry, and has had more than 70 years to perfect its game. It offers a comprehensive suite of payroll, HR, and human capital management services under one umbrella.

ADP is by far the most feature-rich product in my top list, providing every conceivable payroll-related service a business could need. If there’s anything you want to track or do related to payroll or HR in your company, ADP likely offers it.

And that’s exactly why ADP hits the sweet spot for companies with significant workforce expansion dreams. Your business will never outgrow ADP.

Where ADP Payroll Excels

When you’re a behemoth in the payroll services space, you achieve that by delivering some big wins over and over. Here’s where ADP excels:

- Flexible payroll processing: ADP makes it easy to segment and run payroll for groups of any size, set custom payment dates, and manipulate custom fields without limitation. ADP is the reigning leader in this regard among all five on my list.

- Mobile apps galore: ADP offers apps for both iOS and Android on both the admin and employee sides. Admins can easily manage payroll and HR anyplace and anytime on any device. Employees can get the individual information they need on demand, too.

- Integrations are virtually limitless: ADP lists hundreds of third-party tools it integrates with, ranging from basic accounting software to complex enterprise resource planning tools. Head and shoulders above all the competition.

ADP is a tool built to support your business at every stage of growth. One area where this is clear is the flexibility built into payroll automation. Even if your payroll plans are straightforward today, as you grow and expand, ADP will still handle your more complex payroll needs with ease.

Likewise, if your payroll data changes regularly, as it does for one college payroll administrator we interviewed, ADP makes it easy to modify payroll cycles anytime.

“Every semester we have to change it,” one user told us. “So it’s very easy, user friendly. And self-explanatory.”

ADP also makes new employee onboarding equally straightforward. No, the interface isn’t flashy or fun like Gusto—it truly is a no-frills affair. But it is one that gets the job done.

Administrators and employees both find it easy to use. “We didn’t have any issues. I honestly didn’t receive one email.” one administrator noted, with regards to getting employees onto ADP after her company switched from Paychex.

Another area where ADP stands out is the attention it puts into its mobile apps. There are separate apps for administrators and employees. ADP Mobile Solutions goes deep into functionality and simplifies the process for everyone. This is also a standout among the products I’ve covered here.

Like the other products on my list, ADP’s reporting is rated as good by users. Their built-in reports are among the most comprehensive of all the providers on my list.

One area where it particularly excels is extracting data for more complex purposes like audits. One interviewee noted this ease when responding to a bank audit request, telling us “It was really easy to gather the data and submit it to the bank.”

Finally, ADP is exceptionally functional when it comes to integrations. If you can’t find an existing ADP product to do what you need, they offer hundreds of listed third-party tools that you can integrate with their payroll service.

Honestly, the list is so extensive that there likely isn’t a tool you won’t find there.

Where ADP Payroll Could Improve

- Lack of guidance during onboarding: For all its robust functionality, ADP isn’t the easiest option on our list for a new company to onboard with. Many users and reviews note the software has a steep learning curve and little in the way of support during the onboarding process.

- Custom reports are hard to use: While ADPs pre-built reports are well-received, the custom reports are another story. Users repeatedly complain of non-intuitive fields, slow system performance, and results that were not what they wanted.

- Secret pricing: Similar to Paychex, ADP forces you to engage with a sales rep to get a customized quote. However, unlike Paychex where pricing can be found online for its most entry-level package, ADP takes it a step further and offers no pricing information at all.

People who want to be walked through the onboarding process are not going to love ADP. Unlike the hand-holding of Gusto or OnPay, many ADP users felt like they were on their own.

“We weren’t really given the guidance on how to implement the system” one user noted, speaking about her company’s initial onboarding experience.

This lack of guidance probably isn’t going to be an issue for a seasoned HR pro, but for someone without much experience in payroll, it might prove to be an insurmountable hurdle. Novices may prefer the approach of Gusto or OnPay for a less stressful onboarding experience.

Taxes are another area where ADP has an unexpected weakness. Multiple reviews in just the past 12 months claimed that ADP missed a change to the law or compliance rules and caused an issue due. The ADP users we interviewed, both current and former, echoed these complaints.

The difficulty in using custom reports also frequently came up in reviews and the interviews we conducted. In some cases, the problems were enough to motivate a customer to leave for a different payroll service.

One user who left made this clear. “That was one of the major things I had issues with ADP about,” she noted. Custom reports were “not intuitive and easy to use. I had a lot of standard reports I would run and those would do the job, but then the custom ones, that’s when it started to get a little tricky.”

ADP also gives the least pricing information of any product on this list. You have to engage with a salesperson to craft a package for your business, no matter your size or needs, since there is zero information on ADP pricing available on its website and you can’t sign up online. This is dramatically different from how OnPay, Gusto, and QuickBooks present their services.

If you want to consider ADP, you’re going to have to talk to a sales rep—and also like Paychex, ADP has a reputation for very pushy salespeople. Overselling is also an oft-cited complaint from ADP users.

And when you do engage with a sales representative, the services you are promised don’t always mirror the functionality you actually get. “During our negotiations, the sales rep said ‘Oh yeah, you can definitely do that,’ and it turned out we couldn’t,” one user we interviewed said.

ADP Pricing

Similar to Paychex, ADP makes you give them your contact information to get the ball rolling. If you’re a small business that wants a simple, straightforward approach to payroll services at a reasonable price, this alone might turn you off.

However, if you’re a payroll or HR manager at a bigger company, this is probably something you expect. Negotiating for procured services is part and parcel of your role. So despite including small businesses as a target audience on their website, this suggests ADP is really looking for mid- to enterprise-level customers.

Still, ADP makes an effort to woo businesses of all sizes, offering two tiers of service. Each tier offers different packages.

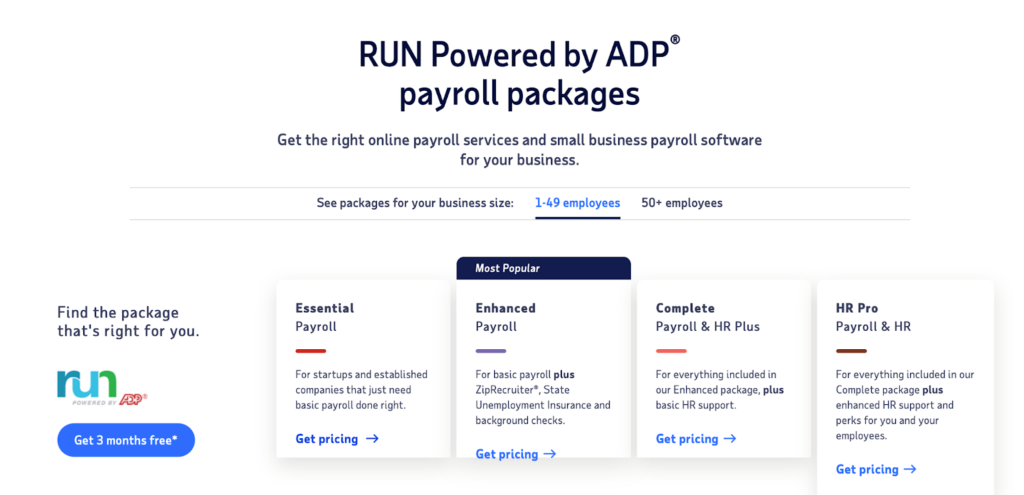

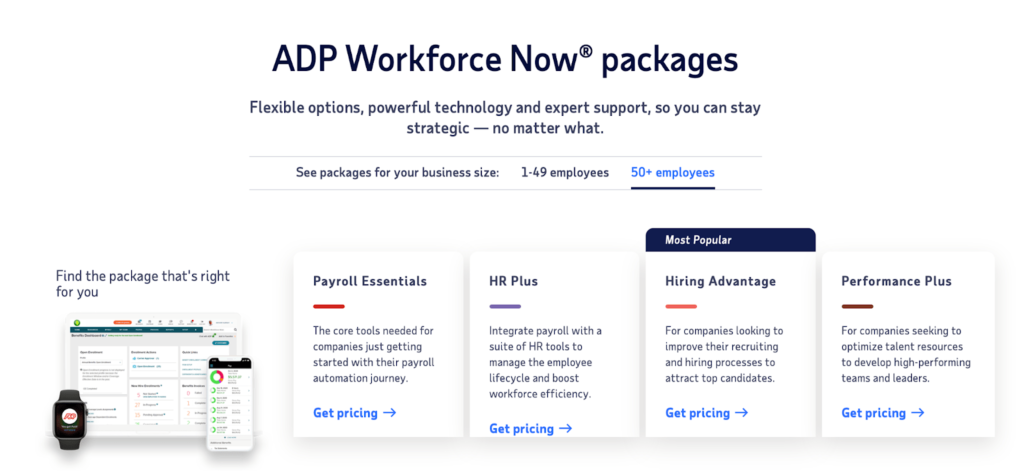

RUN is a product aimed at businesses with less than 50 employees.

We sussed out at least basic information about RUN, so you wouldn’t have to dig through ADP’s website and give up your own contact information.

- Four levels in RUN, with more services added at each level.

- RUN Essential – $59/month plus $4 per person per month. Includes payroll processing, reporting, direct deposit

- RUN Enhanced, Run Complete, and Run HR Pro are all priced by consultation.

For companies with 50 or more employees, ADP offers ADP Workforce Now.

Workforce Now includes all RUN features, plus compliance reports, tailored service and custom implementation, and country-based record keeping. Pricing is by consultation only.

Bottom line: ADP is a great option for companies whose experienced payroll teams won’t need much hand-holding no matter how big the business grows. Learn more about ADP.

The Review Process

There were multiple criteria each product had to meet to make it onto my list.

What It Took to Be Included

For any software to garner a spot in the top six, it had to:

- Consolidate payroll services or offer integrations: The goal is to streamline payroll and reduce the number of tools required to do basic payroll-related tasks, like onboarding, payroll, and taxes. If a tool couldn’t do it all, it had to smoothly integrate with third-party tools that could fill the gaps.

- Be widely used: While there are a lot of solid payroll automation tools out there, many are used in very niche markets. I selected tools used by a variety of small- to medium-sized businesses with mainstream payroll needs.

- Rank highly in user reviews: No software is perfect, and all have flaws. But there’s a difference between a one-off issue and just being a terrible tool. I immediately eliminated any online payroll services that consistently received bad overall reviews.

- Has an established online presence: Sure, there might be some unicorns out there that kill it when it comes to processing payroll. But if nobody’s reviewed them or you can’t find any online discussions about them, it’s hard to know if they actually live up to their marketing hype. If a tool didn’t garner regular mention by users, mainstream product review websites, and other internet resources, I didn’t consider it.

Beyond these key criteria, the software tools I included in the top six all tackle basic payroll management tasks with ease. These baseline requirements include:

- Security: Maintaining the integrity of personal data is paramount, and all of the tools I selected use high-level security measures to protect sensitive information.

- Scalability: The ability to grow as your company grows is a vital part of any online payroll service. While not every tool on my list is capable of taking your business to enterprise levels of growth, they all can keep up as your company moves from few to many employees.

- Payroll scheduling: All my top picks are able to handle a variety of common payroll schedules, including monthly, bi-monthly, weekly, bi-weekly, and custom schedules.

- New hire reporting: Since alerting the government to new workers as they’re added to your team is a legal requirement, I made sure every one of my top picks does this.

What Was Excluded

I didn’t consider any software that:

- Targeted enterprise-level companies: My research and evaluation primarily focused on the tools that best serve small- to medium-sized businesses, with less than 1,000 employees. Of course, if a tool is scalable to the enterprise level, I noted that in the review.

- Was niche-focused: While some of the services listed here offer specific functionality for certain categories (farms, churches, restaurants), all of my top five picks are suitable for any business in any industry.

Once the list of possible top software candidates was whittled down, my research team conducted in-depth interviews with actual users of the software. Here’s some insight into my team’s process.

How We Found Active Users

My team combed through public review sites and social media to find individuals who shared their experiences with one or more of the platforms that made our shortlist.

The team confirmed the users’ identities via LinkedIn. This was a crucial step, since there are countless fake reviews on the internet. This ensured we were dealing with real people who work for real companies.

Once we established contact, we confirmed they were actively working with one of the tools on our list or had worked with it in the past. This first-hand experience was critical to the validity of their comments.

Who We Interviewed

The users we interviewed came from a variety of backgrounds, including solopreneurs managing a small number of contractors to business owners with less than 10 employees to HR professionals responsible for teams of 20-60 to operation managers with a staff of more than 100.

Interviewees ranged in age from early 30s to late 60s. They all had differing levels of payroll experience, with some having little to others with vast HR experience.

The companies they owned or worked for ranged from small healthcare clinics to large family businesses, solo therapy and coaching practices, colleges, and growing start-ups.

The interviews typically lasted 45 minutes to one hour, and we compensated interviewees for their time.

The goal of our personal interviews was to go beyond every payroll service’s marketing hype. We wanted to independently verify whether the service lived up to their claims.

What I Learned Choosing the Best Online Payroll Services

Payroll management is a complex subject and a critical part of any business. While users each have unique needs, all our interviewees touched upon a few common themes during our conversations. The reviews we studied also reinforced these recurring themes.

It Must Be Easy for Administrators…

There wasn’t a single person that downplayed how crucial it was for an online payroll service to be easy to use for the person managing payroll. This ease of use included the initial onboarding process, day-to-day activities, and ongoing support.

There were four key areas we looked at when it came to ease of use:

- Onboarding: How fast will the new user be able to get their company up and running on the tool?

- Integrations: How well does the new payroll service coordinate with other tools the user has already implemented or might need in the future?

- Design: How easy is it for a new user to use the tool?

- Customer service: When problems arise, how responsive is the payroll service? Do they solve problems quickly?

Of course, easy is a subjective idea. A lot depends on how much experience in payroll and HR a user has. Experienced HR managers don’t need or want the same sort of hand-holding that someone with no experience at all might expect.

This diversity among users is why some tools are better than others in specific situations. For the solopreneur, someone new to payroll, or a business owner forced to manage payroll out of necessity, tools like OnPay, Gusto, and QuickBooks are exceptionally popular.

They each have user interfaces designed with these types of users in mind.

As one therapist in her 30s, running a solo practice and using QuickBooks Payroll told us, the confidence to be able to do these tasks herself was wonderful. An HR manager in her 50s, overseeing multiple $1 million businesses, agreed. “Anybody can do payroll if it’s with Gusto,” she said.

At the other end of the spectrum, Paychex and ADP are more complex tools that generally assume the administrators will have some basic knowledge of payroll. These bigger, more robust tools don’t pay as much attention to guiding the inexperienced user.

And this can make things difficult for those less experienced users, like the de facto HR person at a small company that uses Paychex. “I’m having to figure it out a little bit on my own,” she told us.

…And for Employees, Too

Ease of use isn’t limited to the administrator side of the equation. Businesses want to streamline the onboarding process for new users, too. Not only because it helps new hires start off on the right foot, but it also saves the company time and creates efficiencies.

When it came to assessing this factor for each product on our list, we considered three key areas:

- Onboarding: How easy is it for an employee, regardless of technical savviness, to submit the paperwork involved with starting a new role?

- Time tracking: How efficiently can employee time be recorded and integrated into the payroll system?

- Accessibility: When an employee needs personal information, like a W2 or paystub, can they get that information without going to HR?

Gusto was one of the top contenders in this regard. The fun interface simplified all things employee-related, making it easy for even the most tech-challenged employees.

One HR manager we spoke to broke down exactly how easy employee onboarding and self-service are with Gusto. “A lot of times I’m hiring people that don’t have a lot of [tech] experience, but they don’t have trouble.”

The bigger players in payroll, like ADP, get high marks in this regard, too. One college administrator in her 50s noted, “I have [no issues] with onboarding, time management, and attendance. The core of human resources, ADP has captured that.”

Robust Reporting Is a Real Requirement

Another important facet of a great online payroll service is how efficiently a user can pull data from the system. Whether it is to verify PTO or satisfy an IRS audit, getting the right information without drama is really important.

We scrutinized each of these factors when we assessed each tool’s reporting function:

- Accessibility: How fast can a user generate the reports they need?

- Standard reports: Are there enough pre-built reports covering the most common needs? And how easy is it for a user to find and use them?

- Customized reports: If a user needs something out of the ordinary, how easily can they build their own specialty report?

All the tools on our list delivered when it came to pre-built reports and how easy they are to find and generate. As the owner of a 100-person family business noted about Paychex, “They have a pretty extensive catalog of reports. I can’t imagine that if there wasn’t something that you could find, you could probably build it pretty easily.”

ADP Workforce Now, the company’s payroll solution for over 50 employees includes fairly deep reporting features. You can create your own dashboards with their drag-and-drop interface, so no code is necessary.

Some of the lighter tools don’t give you nearly as much freedom to create your own dashboards.

Customized reports were the wild card in this category. Users consistently complained on all five platforms when it came to not being able to find the specialized data they wanted.

Make Sure It Has Your Back at Tax Time

Perhaps the most critical part of any online payroll service is how well it keeps a business out of trouble with the tax authorities. Tax troubles can quickly escalate to expensive penalties. This can cripple a business.

We looked at how each tool handled all things tax:

- The basics: How well did the software master the most mundane tasks, including proper employee withholding and end-of-year reports?

- Local taxes: If a business is subject to any specialty taxes, how well does the tool manage those unique tax situations?

- Tax changes: Businesses use payroll services to take the guesswork out of taxes. As tax laws change, how well does the software keep up?

- Error management: Payroll is still managed by humans, and humans make mistakes. How the service manages error correction is hugely important, since anytime the IRS is involved situations can get sticky fast.

Overall, each tool more than adequately managed the tax basics. But not all of them handled everything else perfectly. OnPay couldn’t automate local taxes, for example, and QuickBooks Payroll has limitations on multi-state tax situations.

Most surprisingly, ADP seemed to struggle with tax management. One user we interviewed noted that ADP dropped the ball on managing a straightforward tax law change, causing their pay stubs to be out of compliance. It took the company’s attorney to catch the error.

While that user stuck with ADP, others left after experiencing tax issues with the behemoth. One who manages HR for multiple businesses said she left ADP for Gusto after ADP didn’t correctly report taxes, causing her company to receive an unexpected tax bill.

“That was the end of our contract with ADP,” she noted. “I just don’t really want to mess around with anything having to do with taxes.”

Paychex, on the other hand, was praised for fixing tax issues quickly. “We once had a hiccup with some reporting at the end of the year,” she said. “Paychex took full responsibility and credited us a couple months of fees.”

The Top Online Payroll Services in Summary

The best online payroll services accurately pay both salaried and hourly workers. Pay runs are accurate every time, and all of your tax obligations are calculated automatically. In some cases, payroll taxes are even filed for you—ensuring compliance.

For small business owners and experienced HR professionals alike, online payroll software makes your life easier. Gusto and Paycor are our top recommendations, but any service on our list is a viable option to consider.