How to promote banking offers in 2024

The financial vertical in affiliate marketing stands out for its complexity and profitability. Many marketers seeking gains in finance face insurmountable challenges, but those who master it can sustain themselves for several months.

Today, we’ll explore how to promote financial banking offers. We’ll delve into methods of promotion and highlight the advantages of this vertical.

What types of offers are available in finance affiliate marketing?

Surprisingly, nearly everything related to money falls under the finance vertical. The financial sphere is extensive, and each offer within it has its specificity. Here are examples of offers:

1. Banks: loans for individuals/businesses, including credit cards, mortgages, insurance and refinancing.

2. Microfinance: short-term microloans and special offers from microfinance organizations.

3. Business models for sale: offers to acquire ready-made business models.

4. Legal support and broker services: consultations and transaction support from experienced professionals.

5. Portfolio diversification: investments in various assets for financial stability.

6. Insurance: almost all types of insurance.

7. Binary options: a simplified way to invest and bet on changes in the value of financial assets.

8. Job opportunities: HR offers for professional growth.

Advantages of finance banking offers

Despite intense competition and demands on webmasters in the finance sector, it’s a highly profitable niche with several advantages:

1. Wide target audience: you can work with individuals aged 18 to 65, depending on the offer, and there are significant scaling prospects.

2. Excellent conversion: numerous offers from reputable companies positively impact conversion rates.

3. Generous rewards: rates ranging from $1 to $200 or more, depending on the offer.

4. Variety of target actions: issuing debit cards, loan approval, first financial transaction, etc.

5. Stable ROI: working with white offers allows for predicting advertising budgets due to the long life of bundles and profitability.

What is RichAds?

🔝 Push and pop ads,

🔼 Domain redirect traffic,

🔝 CPM for domain ads starts from $1.5,

⏫ CPC for push ads starts from $0.005,

🔼 CPM for pops — from $0.5 in Tier 3, $1 in Tier 1,

⏫ large volumes of available traffic in more than 200 goes.

Which traffic sources are suitable for the finance affiliate programs?

Numerous traffic sources suit financial affiliate marketing, given the diverse nature of offers. Each source has its advantages and disadvantages, with the choice depending on the target audience and offer characteristics.

Sources for the finance vertical:

1. Contextual advertising: an effective but cost-intensive way to promote offers. Successful customer acquisition through context requires skill in handling keywords, often working in conjunction with landing pages.

Google does not accept financial offers due to its policy. To bypass Google’s restrictions, marketers use cloaks styled as personal blogs or financial journals.

2. Social media advertising: utilizing targeted ads and group publications. It’s crucial to ensure that the offer complies with social network rules before launching ads. Common restrictions and prohibitions for financial campaigns include fraud and avoiding misuse of prominent brand images.

3. Email campaigns: a complex method requiring email collection and meticulous targeting. Otherwise, emails might end up in spam. Offers in emails, such as promotions (interest-free credit) and discounts (free service), can attract more attention.

4. UFT (Unconditionally Free Traffic): “time is money” is the first thing that comes to mind when mentioning UFT. There are numerous ways to attract such traffic to financial offers, ranging from creating your own group on social networks to filling out profiles on internet services for advertising placement.

5. Push notifications: notifications similar to messages from social networks, less susceptible to «banner blindness». Push notifications in the finance vertical have numerous advantages and a couple of drawbacks:

Pros:

- Click cost: compared to contextual and social media, clicks are relatively inexpensive.

- Lenient moderation: if you prefer to avoid dealing with anti-detects, proxies, and account farming, push ads are a suitable option.

- Quick setup: setting up a campaign with ready-made creatives can be done in a few minutes.

- Low competition: major players often choose other traffic sources, making push ads accessible with a smaller budget.

Cons:

- Creatives: well-known banks may request approval for your creatives to protect their reputation. Testing new creatives is a constant necessity in push ads, but personal managers at RichAds can assist in creating them.

- Targeting: in push ads, you cannot choose gender and age demographics. It’s advisable to warm up the audience to pre-landers.

How to promote banking offers?

While information about the financial vertical may seem guarded, we can provide advice for both beginners and advanced affiliate markers.

- When working with contextual advertising, try pairing it with a showcase website. This helps offer customers a choice from dozens of potentially interesting proposals.

- For beginners, advertising debit cards is a good choice since the audience is broad, and there are many triggers to engage them: cashback, design, free services, delivery, and bonuses from banks.

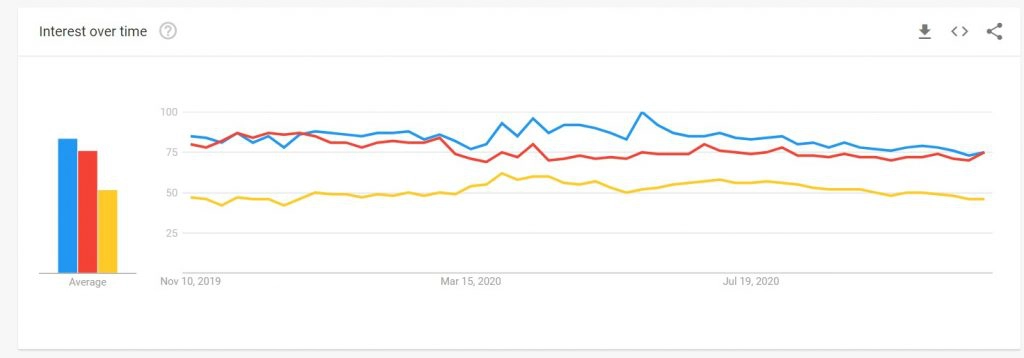

- The most lucrative period for the financial vertical is spring. During this time, many people take out loans as numerous businesses, including the hotel sector and fitness industry, emerge.

- Similar to other verticals like Nutra and E-commerce, interest in the finance vertical grows before holidays. People may want to apply for consumer loans, insurance, and get additional cards for leisure.

- When dealing with push traffic for finance, continuously optimize whitelists. Fortunately, RichAds offers a Performance mode that daily adds new effective sources, aiding newcomers in achieving better results through campaign auto-optimization.

- Utilize the best geos. According to RichAds statistics, these geos currently have good conversion rates for banking offers with push traffic: TUR, USA, BRA.

- Craft compelling push headlines. Enhance your campaign with catchy headlines. To make it easier for you, we’ve prepared an article with a list of converting headlines.

What is RichAds?

🔝 Push and pop ads,

🔼 Domain redirect traffic,

🔝 CPM for domain ads starts from $1.5,

⏫ CPC for push ads starts from $0.005,

🔼 CPM for pops — from $0.5 in Tier 3, $1 in Tier 1,

⏫ large volumes of available traffic in more than 200 goes.

Which creatives and landing pages are suitable for online finance affiliate marketing?

In the finance vertical, especially in banking offers, it is crucial to pay special attention to creating trustworthy creatives and landing pages. Even the most carefree users scrutinize everything when it comes to money.

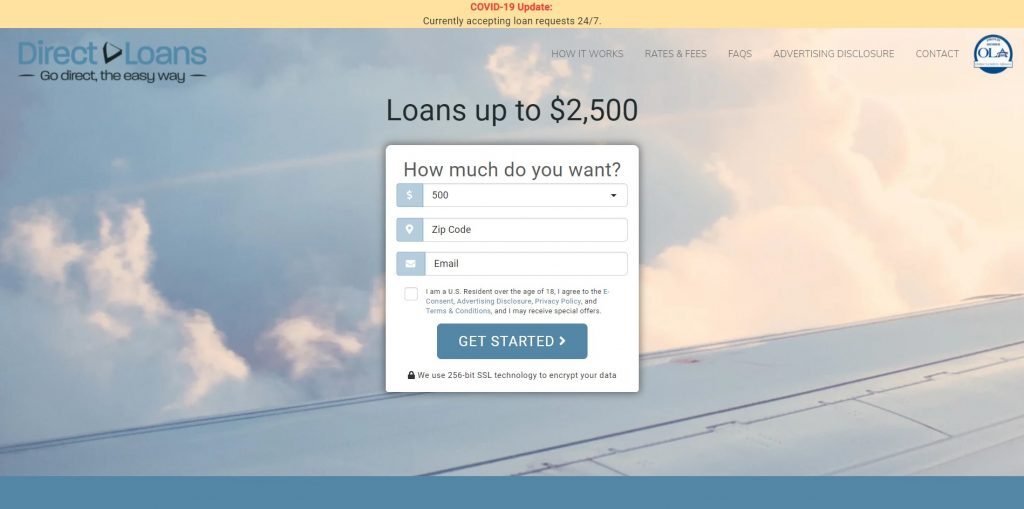

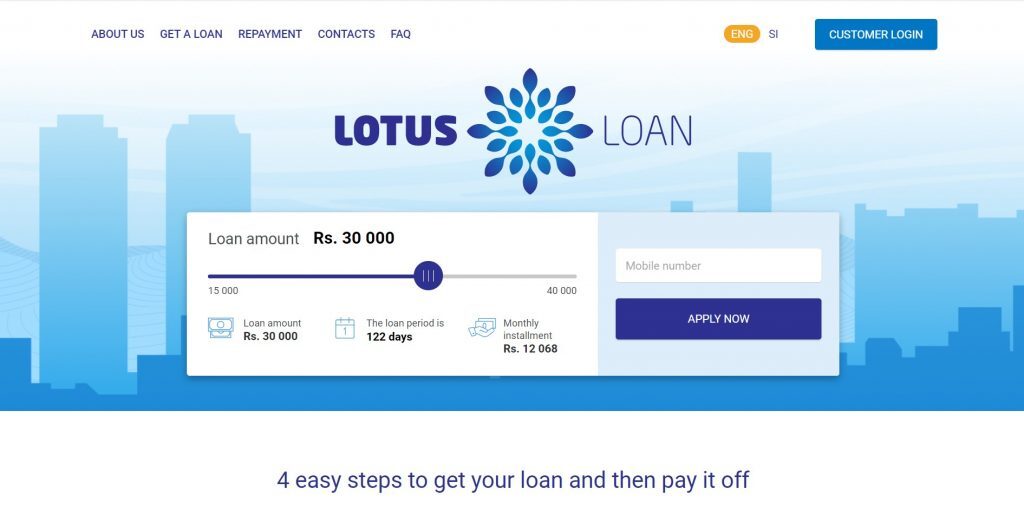

Examples of landing pages for the finance affiliate marketing

The formula for a good landing page is relatively simple. Ensure that your landing page has an attractive design, a clear offer, elements that inspire trust (answers to frequently asked questions), and, of course, compliance with the legislation of the geo in which you operate.

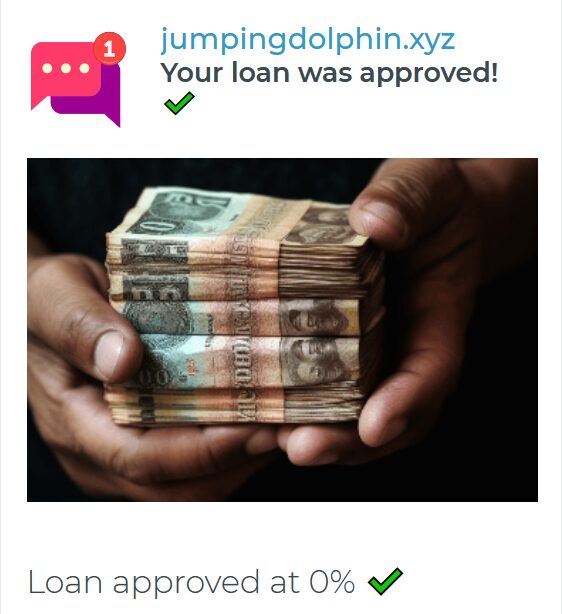

Examples of creatives for the finance vertical

As mentioned earlier, creatives play a crucial role in the finance sector. To make creatives highly clickable, you can address the needs of the target audience: financial requirements, insurance needs, etc. Highlight the uniqueness of the product, such as free services, interest-free loans, etc. You can also use photos of well-known individuals from the geo in which you operate. Make your creative as attention-grabbing as possible.

Creatives may convert poorly for various reasons: low image quality, dullness, lack of a call to action, and monotony.

Here are examples of creatives for finance affiliate marketing:

Conclusion

Affiliate marketing for financial banking offers has been, is, and will remain relevant. New products and offerings for diverse target audiences continually emerge. There is already a trend towards the development of the financial sector in Tier 3 countries, and the future promises even more. Stay updated on the market with RichAds and maximize your earnings!

What is RichAds?

🔝 Push and pop ads,

🔼 Domain redirect traffic,

🔝 CPM for domain ads starts from $1.5,

⏫ CPC for push ads starts from $0.005,

🔼 CPM for pops — from $0.5 in Tier 3, $1 in Tier 1,

⏫ large volumes of available traffic in more than 200 goes.

The post How to promote banking offers in 2024 appeared first on RichAds Blog.